ALBAWABA – China’s economy is showing signs of recovery as retail sales grew in October at the fastest rate in five months, official data released Wednesday showed, though growth remains sluggish in the world’s second-largest economy.

China fell back into deflation last month, while exports continued to fall, highlighting the challenge for officials grappling with weak domestic consumption and a debt-laden property sector. In addition to sluggish growth, at best, since Beijing abolished strict zero-Covid curbs in late 2022.

Retail sales jumped 7.6 percent on-year in October, according to the National Bureau of Statistics, up from September's 5.5 percent, as reported by Agence France-Presse (AFP).

In fact, October’s retail sales growth marked the highest since May, AFP reported.

Food and beverage sales in particular spiked in October, growing 17.1 percent year-on-year, as a longer-than-usual eight-day national holiday at the start of the month drew crowds to restaurants.

Meanwhile, industrial production growth in October ticked up to 4.6 percent from September's 4.5 percent, while urban unemployment stayed flat at 5.0 percent.

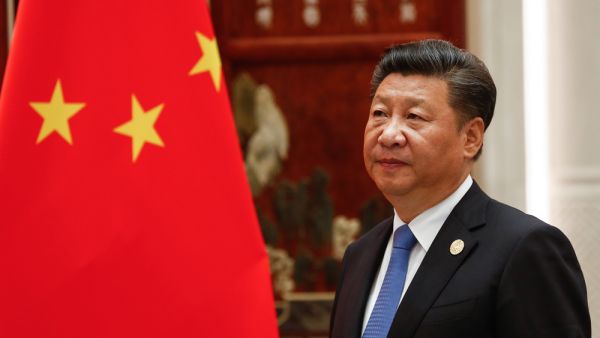

China's economy is showing signs of recovery with industrial output and retail sales both posting growth in October - Shutterstock

Unemployment data no longer includes a breakdown for 16- to 24-year-olds, after it hit a record high in June at 21.3 percent, according to AFP.

On the other hand, Chinese authorities are faced with a challenging task as any aggressive monetary support would further widen interest rate differentials between China and the West. Especially in regards to the United States (US) Dollar, which would dent an already weakened yuan, intensifying capital outflows.

In the meantime, Beijing is hesitant to return to the big-bang fiscal stimulus of the past which created massive debt and hamstrung the economy.

Overall, China’s economy grew faster-than-expected in the third quarter, with analysts generally expecting it to reach the government's full-year growth target of around 5 percent by the end of the fourth quarter. However, a full-blown recovery is still some time away, according to Reuters.

The yuan held near over a two-month high after surprisingly softer US inflation reading overnight boosted bets that the Federal Reserve had reached the end of its tightening cycle.

A string of sub-par economic data in the first half – which came despite the lifting of zero-Covid curbs at the end of 2022 – led the government to unveil a number of targeted stimulus measures. These measures were aimed at supporting key sectors, particularly the troubled, debt-laden property industry.