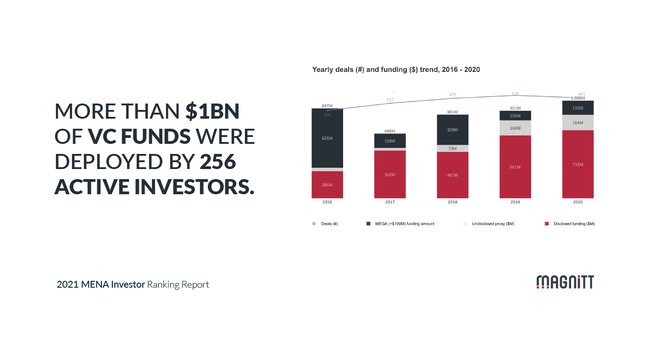

Even though most business sectors have felt different levels of negative consequences of the coronavirus pandemic, the venture investment in our region seems to be a rare exception.

Based on data provided by MAGNiTT in February 2021, the MENA region has seen record-breaking numbers of venture investments during 2020, which indicates an unexpected growth in the market that does not seem to have been greatly impacted by the pandemic.

The report shows that MENA markets have continued to attract at least $1 B in venture investments in start-ups throughout 2020, which have been generated by 256 active investors, with a 19% increase compared to the previous year.

While it is hard to know whether the reason behind this solid number is a result of the successful containment efforts by MENA governments, especially when we talk about GCC countries, the region is still drawing the interest of investors from all over the world.

Given that e-Commerce and FinTech start-ups have led the 2021 rankings in terms of sectors that received the biggest investments, analysts argue that the MENA's high percentage of internet penetration by its mostly youth population is amongst the reasons investors are taking risks in our region in particular.

Even though e-Commerce attracted the biggest investments, Fintech was the most popular sector with more than 63 firms investing in its start-ups.

Of the 256 investors who have trusted MENA businesses during 2020, 25% were international non-MENA based. According to the MAGNiTT report, 11% of them were based in the US while about 7% were based in Europe.

Do you think this positive impact is going to continue growing in 2021? What factors can help in boosting investors confidence in MENA start-ups even more?