Reliance Industries' subsidiary Reliance New Energy Solar (RNESL) announced on Tuesday it would invest $144 million in U.S. energy storage company Ambri Inc, joining billionaire Bill Gates, Paulson & Co and few other investors.

Reliance New Energy Ltd (RNESL), a wholly owned subsidiary of #RelianceIndustries Ltd. (RIL), has announced investment of $50 million in Ambri Inc – an energy-storage company in Massachusetts, #USA https://t.co/2EPnVFXhMW

— Outlook Business (@OutlookBusiness) August 10, 2021

As part of the investment, RNESL will put in $50 million to acquire 42.3 million shares of preferred stock in Bill Gates-backed venture.

"The investment will help the company commercialise and grow its long-duration energy storage systems business globally. RNESL will invest USD 50 million to acquire 42.3 million shares of preferred stock in Ambri," RIL said in a statement.

In addition, RNSEL said it is in talks with the energy storage company for an exclusive collaboration to set up a large-scale battery manufacturing facility in India.

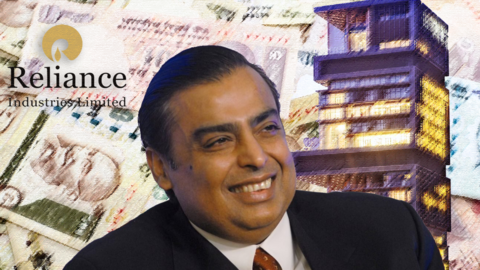

The investment comes months after Reliance Industries revealed a $10 billion green energy plan in its drive to become a net carbon zero company by 2035.

“We are exploring new and advanced electro-chemical technologies that can be used for such large-scale grid batteries to store the energy that we will create. We will collaborate with global leaders in battery technology to achieve the highest reliability for round-the-clock power availability through a combination of generation, storage, and grid connectivity,” - Reliance Industries chairman Mukesh Ambani.

In a separate statement, Ambri said it would use the funds to design and build high-volume manufacturing facilities in the United States and internationally that will supply its long-duration battery systems to meet growing demand from the grid-scale energy storage market and large industrial energy customers, such as data centers.