From the story of the SilkRoad website, to China and India clamping down on ICOs, it is fair to say that something about the blockchain makes governments and policymakers more than a little nervous.

The co-inventor of the Open Index Protocol, Amy James, summarizes what is in effect a detente between blockchain developers and policymakers everywhere. “Since Bitcoin was first spawned there have been lots of parties that have tried to kill it from various players in the financial services industry, to foreign governments, to members of the US Senate, to tech companies, to people who just wanted to protect people from what they worried was a scam - and they tried to stop it in a variety of ways."

According to James, no one has managed to permanently deter blockchains like Bitcoin, Raven and Flo because these systems are decentralized.

Pragmatic voices in the U.S. government are beginning to perceive that cooperation rather than coercion might be a more productive approach. Congressman Patrick McHenry recently observed “the world that Satoshi Nakamoto, author of the Bitcoin white paper envisioned, and others are building, is an unstoppable force. We should not attempt to deter this innovation. And governments cannot stop this innovation.”

“Since Bitcoin was first spawned there have been lots of parties that have tried to kill it from various players in the financial services industry, to foreign governments, to members of the US Senate, to tech companies"

No More Central Banks?

In all likelihood, not everyone on Wall Street will agree. Current accounting methods are based on a double-entry book-keeping system which is over 600 years old. The blockchain utilizes a ‘triple-entry’ accounting system in which transactions are cryptographically verified by solving complex mathematical problems. This new layer of verification could change current accounting loopholes, such as cross-jurisdiction tax havens or other conventions.

How do the stock market or national economies function without a central bank?

Secondly, cryptocurrencies are not operated by banks, or by any other centralized institutions. How do the stock market or national economies function without a central bank? No one quite knows the answer to that yet.

Blockchain Never Forgets

Over the past 5 years it has become easier for mega-platforms to remove, de-rank and shadow-ban content that is hosted on their servers. The old adage that the “Internet never forgets” is no longer completely true. According to James, this too is changing. “As the use of blockchain grows the memory of the web will do a 180, and one of the undeniable realities is that forcing content to be censored off the Internet will just no longer be possible.” Basically, “there is no webmaster to subpoena and no data-center to raid.”

This has implications for digital creators and publishers, and serves as a reminder that blockchain applications are not limited to financial transactions.

“As the use of blockchain grows the memory of the web will do a 180, and one of the undeniable realities is that forcing content to be censored off the Internet will just no longer be possible.”

Good News for Policy Makers

If you’re a besuited policy maker, sitting behind an oaken desk twiddling your fingers right now, whispering “control” while pensively stroking an evil looking white cat, there may actually be some good news for you. Mass-blockchain adoption will also make it easier for governments to tax citizens and spot financial fraud.

“It’s important to understand the capability of the technology and where the regulation could be enforced. Blockchains don’t mean regulations can’t be applied.

While it might not be possible to kill blockchain technology, it could be possible to regulate aspects of how we behave across these decentralized protocols. “It’s important to understand the capability of the technology and where the regulation could be enforced. Blockchains don’t mean regulations can’t be applied. People and businesses at the application layer of the tech stack can be regulated if needed.”

A Blockchain Freedom Dividend?

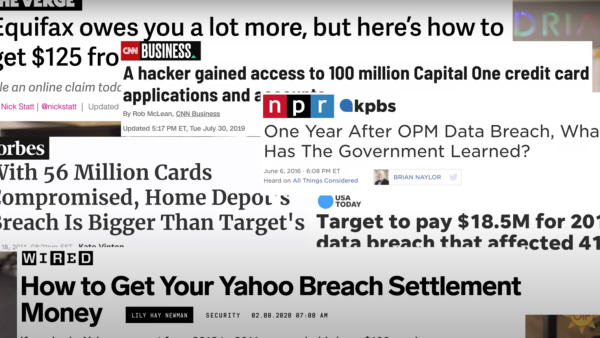

The way tech companies store our credit card details, health data and social relationships is becoming a form of economic value in its own right; empowering new forms of surveillance, and new incentives for data-mining without informed consumer consent.

The way tech companies store our credit card details, health data and social relationships is becoming a form of economic value in its own right

Existing models also make it difficult for online creators to become economically independent, creating an emerging digital economy which has become insidiously exploitative at the same time as it proffers new forms of self-expression and opportunity. Blockchain based payment systems allow consumers to protect their privacy, while smart-contracts give creators more tools to set commission rates and avoid terms of service that make no sense.

Rather than destroying government and finance, the blockchain could help renew and accelerate new forms of trade, digitalization and globalization. Let’s call it the ‘Blockchain Freedom Dividend’. One day, policymakers might just learn to love it.

Full disclosure: Al Bawaba is experimenting with the Open Index Protocol. The views expressed in this article do not necessarily reflect those of Al Bawaba News.

John McAfee’s Blockchain Future: The DeLorean, Satoshi Nakamoto and the End of Government (Podcast Promo)

Blockchain City: On Dubai’s Blockchain Strategy & the Open Index Protocol

The Internet Just Called. It Wants its Creators Back.

‘The Jungle Outside’ On Balkanized Internets, Public Space and the Blockchain

What if Digital Remix Culture was Legal on the Blockchain?

An Ancient Library in Alexandria Could be the Future of the Blockchain

‘Began, the Platform Wars Have!’ On Blockchain Creators and the Dark Side of Cyberspace

A Public Index for the Web? How the Blockchain Could Potentially Fight Deepfakes