With Gaza on the brink of genocide, steady oil prices and weaker US dollar point to possible relief for traders

ALBAWABA – United States (US) Treasuries slipped in early trading Monday, along with the US dollar, in a sign of optimism over the situation in Gaza, Palestine, with oil prices stable and risk-sensitive currencies edging higher.

Oil traded mostly flat after surging last week on the heels of the surprise attack by Palestinian resistance fighters in Gaza against Israeli occupation assets and settlements.

Investors are holding, according to Reuters, to see if the conflict draws in other countries, which would disrupt supplies in the region and drive oil prices higher.

With Gaza on the brink of genocide, the Israeli onslaught drawing in regional players would deal another fresh blow to the global economy.

Turmoil drives investment away from risk-markets to safe havens, driving down oil prices and boosting the US dollar - Shutterstock

Brent futures were last flat at $90.89 per barrel at 0419 GMT, Reuters reported, while US West Texas Intermediate (WTI) crude slipped $0.02 to $87.67 a barrel.

Oil prices for both benchmarks climbed nearly 6 to 7.5 percent over the weekend, posting their highest daily percentage gains since April, but have since traded in a narrow range, according to Bloomberg.

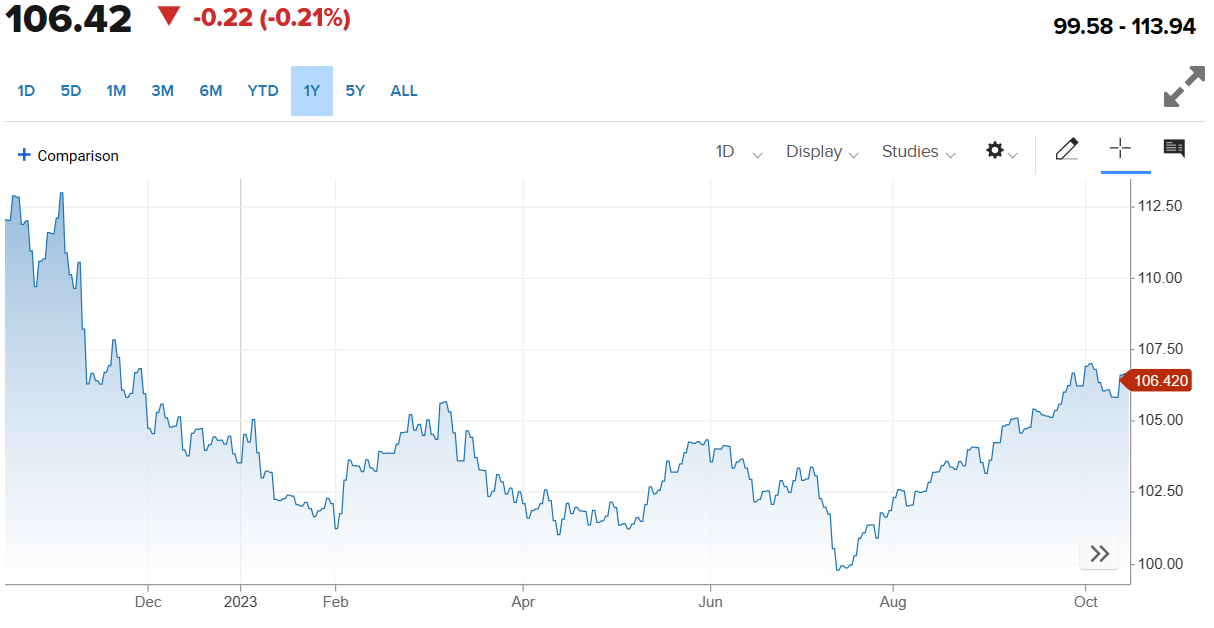

Despite being higher over the month since mid-September, the US dollar has fallen more than 0.20 percent on Monday, according to Trading View’s US Dollar Index monitor.

The ICE US Dollan Index - CNBC

With thousands of troops massed near Gaza and the airborne onslaught ongoing, the US boosting military presence in the region and Israelis actively provoking Arab neighbours, it is difficult to predict next steps in what could easily spiral into a regional war.

Oil prices are weighed by conflict in crude-rich Mideast, but US dollar surges on drums of war

Yet, broiling conflicts usually drive demand on safe havens, such as the US dollar, treasuries and gold. Instead, all of the signs point to optimism in global markets.

The dollar and treasuries are down, gold has also lost most of its recent gains, and oil prices remain stable for the time being.

However, the risk-sensitive Australian dollar edged higher early on Monday, as reported by Bloomberg, before shedding gains and sliding 0.38 percent by midday, according to Trading View’s AXY index.

Oil prices and the US dollar are both affected by war and armed conflict - Shutterstock

Remarks from US officials on there possibly being no more need for further rate hikes in the next couple of months have also contributed to a slightly weaker US dollar in the past few days.

Overall, while broader gauges of market volatility remain subdued, the Swiss currency has surged to the highest in more than a year against the euro, and the US dollar advanced for a fourth week last week, before breaking its streak this weekend. Whereas volatility in S&P 500 stocks has also increased.