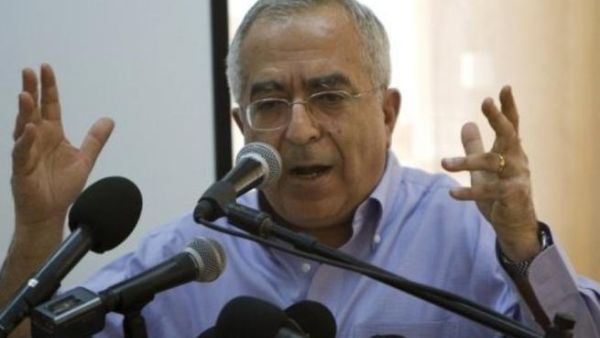

Palestinian PM Salam Fayyad told reporters yesterday (Sunday) evening that he hopes to reduce the Palestinian Authority’s budget deficit through increasing taxes and reducing spending. The PA’s budget deficit, which was $350 million at the beginning of 2011, tripled to $1.1 billion by the end of the year. The shortfall was due to a combination of the global financial crisis and the failure of donor countries to follow through on their pledges. Although the budget was designed with a planned $1 billion in aid, only $270 million was received.

One way the PA is trying to plug the gap is through an increase in taxes. The minimum and maximum income tax rates on individuals will be raised to 5 and 30 percent, respectively. Additionally, taxes will be imposed on a greater number of entities, and taxes on land and property trading will also be raised.

The PA is also trying to reduce costs by offering its employees early retirement. Out of 153,000 persons employed by the PA, 36,000 have been asked to retire early, including civil servants who have worked for over 15 years and security personnel who have worked over 20 years. Palestinian law allows the PA to force employees into early retirement. This measure has come under criticism from the civil servants’ union whose head, Bassam Zakarneh, indicated that 80 percent of those forced to retire would not receive full pensions and 65 percent of them have outstanding bank loans.

In announcing the anticipated measures Fayyad said, “We are trying with these measures to save up to $350 million so that the budget deficit does not exceed $750 million as part of our ongoing bid to reduce reliance on foreign aid and avoid the constant threats to cut aid.” The government owes $1.4 billion in unpaid bills to private sector contractors, including construction companies and medical suppliers. It hopes to keep its 2012 budget, which will be approved in March, down to $3.5 billion.