Abu Dhabi Investment Office’s Ventures Fund Expands to Support Later-Stage Innovators

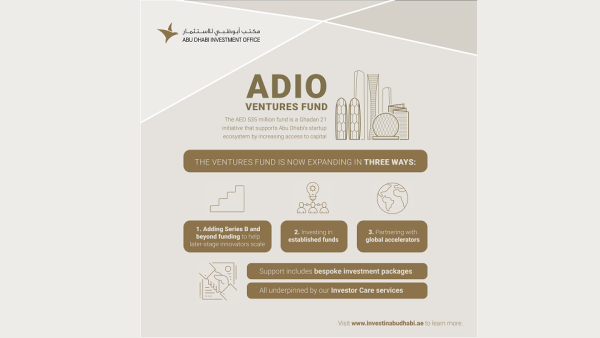

The Abu Dhabi Investment Office (ADIO) has expanded the scope of its Ventures Fund to increase support for the growth and expansion of innovation-focused companies in the emirate. The Ventures Fund will now participate in Series B and beyond financing rounds, invest in established regional and global funds and collaborate with global accelerators.

The Ventures Fund, established in 2019, is an initiative of the Abu Dhabi Government’s Ghadan 21 accelerator programme designed to support the emirate’s startup and venture capital ecosystem. The AED 535 million fund works to increase access to capital for startups and to date has deployed capital through matching programmes for new fund managers and early-stage startups.

To support later-stage companies that are in expansion mode and ready to scale, ADIO has expanded the parameters of the fund to include investment in later-stage companies. ADIO will also assess opportunities to act as the lead investor. In addition to funding, ADIO will create bespoke incentive packages, underpinned by its Investor Care services, to support the continued growth of these companies in Abu Dhabi.

The Ventures Fund is also expanding its support for funds beyond new fund managers. ADIO will now invest as a limited partner (LP) through established global funds that are investing in innovation-focused companies in the MENA region and through collaboration with global accelerators.

Dr. Tariq Bin Hendi, Director General of ADIO, said: “The Ventures Fund is actively supporting Abu Dhabi’s innovation ecosystem and attracting high skilled talent to Abu Dhabi. Initially, we saw a gap in the funding for early-stage startups, and I am pleased that our matching programmes are already helping to close this gap. We now see an opportunity to not only help startups get off the ground but also to continue to expand and scale.”

Bin Hendi continued: “Abu Dhabi is safe ground for innovation, a place where entrepreneurs and businesses can confidently take commercial and creative risks. An expanded, more flexible and efficient Ventures Fund will ensure more companies can make the most of the opportunity to innovate and grow in Abu Dhabi.”

ADIO recently announced investment through its Ventures Fund in innovation-focused companies Securrency, TruKKer, Sarwa, YACOB and Okadoc, and venture capital firm, UAE-based Global Ventures.

Background Information

The Abu Dhabi Investment Office (ADIO)

The Abu Dhabi Investment Office (ADIO) is the government entity responsible for attracting and facilitating investment in the Emirate of Abu Dhabi. ADIO enables opportunities for innovative investors and businesses of all sizes, facilitating connections across Abu Dhabi’s innovation ecosystem to help them establish and grow in the emirate. With a comprehensive range of tailored services and incentives, ADIO helps businesses achieve long-term, sustainable success in the market and across the region.