Bahrain Islamic Bank Encourages Customers to Utilise Its Digital Platforms

Since the beginning of the COVID-19 pandemic, Bahrain Islamic Bank (BisB) has taken swift and necessary precautions at its branches and financial malls to maintain social distancing measures in line with the wise directives of the Kingdom’s leadership and official authorities. In a bid to safeguard the safety of its employees and customers, the Bank has continued to urge its Retail and Corporate customers to utilise the Bank’s various digital banking platforms available in order to minimise exposure and avoid unnecessary queueing. Currently, almost all daily customer transactions can be conducted online from the safety of their homes.

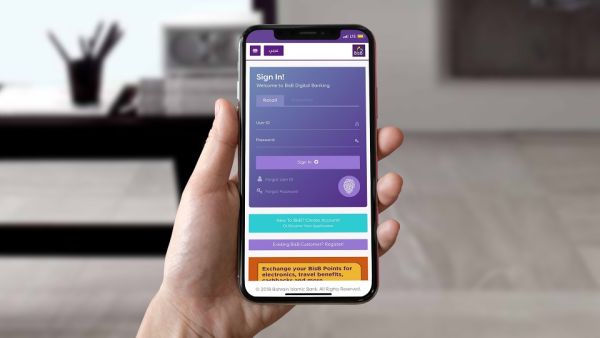

In the first quarter of 2020, BisB launched a number of digital products and services as part of its strategy of simplifying its customers money matters, enabling customers to perform a wide range of banking transactions, hence eliminating the need for customers to visit the branches. This includes Tejoori Instant Finance, which allows customers to obtain instant finance in less than 5 minutes against a pledge from their Tejoori account via BisB Digital and BisB Corporate Digital, as well as Contactless cards which enable retail customers to make purchases at any Point of Sale (POS) system simply by tapping the contactless-enabled payment device, further reducing any potential risk of infection from contaminated surfaces. In addition, the Bank recently rolled out its latest Open Banking service which provides customers with the transparency and convenience of viewing and managing multiple bank accounts, all through a single streamlined application window.

Background Information

Bahrain Islamic Bank

Incorporated in 1979 as the first Islamic bank in the kingdom of Bahrain, and the fourth in the GCC. Bahrain Islamic Bank (BisB) has played a pivotal role in the development of the Islamic banking industry and the Kingdom’s economy. The Bank operates under an Islamic Retail banking licence from the Central Bank of Bahrain and is listed on the Bahrain Bourse.

At the end of 2016, the Bank’s paid up capital was BD 101 million, while total assets stood at BD 1042 million. The Bank’s modern branch network comprises 5 branches, 4 innovative financial malls, and 56 ATMs located throughout the Kingdom. A steadfast focus on continuous innovation, strong corporate governance and risk management, employee development, and the use of state of the art technology to deliver superior customer service, has cemented Bahrain Islamic Bank’s position as the leading Sharia’a – compliant bank in the Kingdom.