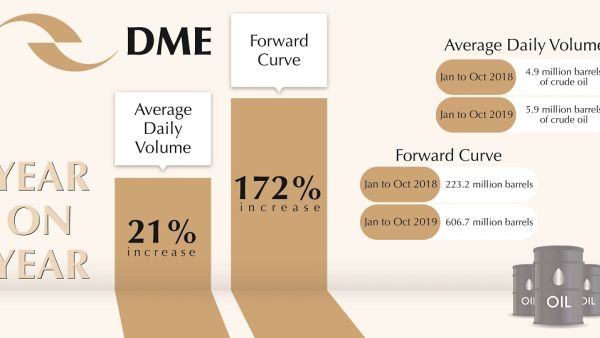

DME Registers 21% Increase in Exchange Trading Volume and 172% in Forward Curve Trading

Dubai Mercantile Exchange (DME), the premier international energy futures exchange in the Middle East, today announced a 21% increase year-on-year in exchange trading activities, along with 172% increase in forward curve trading, following Saudi Aramco’s adoption of DME Oman in its official selling price in October 2018.

In 2019, DME registered an average daily volume of 5.97 million barrels of crude oil from January to October, up from 4.95 million barrels for the same period in 2018. Forward curve activities reached a total of 600.7 million barrels from January-October 2019, compared with 223.2 million barrels in the corresponding period in 2018.

Raid Al-Salami, Managing Director, DME, said: “We are witnessing a growing interest among crude oil sellers and buyers to trade and participate in the price discovery through DME, the only regulated energy exchange in the biggest oil-producing regions.”

“DME today plays a major role as the most reliable pricing point for Middle Eastern crude oil going East, due to its growing and diversified customer base, the transparency of DME Oman benchmark and its ability to capture the real supply-demand situation in the East of Suez market. The tremendous growth we experienced over the first 10 months of the year is a true testimony to our unmatched credentials.”

DME delivers between 15 and 22 million barrels of Oman crude every month. A wide range of customers lift physical Oman crude via the Exchange delivery mechanism, shipping the oil to refineries across Asia.

Background Information

Dubai Mercantile Exchange

The Dubai Mercantile Exchange Limited (DME) is the premier international energy futures and commodities exchange in the Middle East, providing a financially secure, well-regulated and transparent trading environment.

The DME is majority owned by core shareholders Tatweer (a subsidiary of Dubai Holding), Oman Investment Fund and CME Group. Global financial institutions and energy trading firms such as Goldman Sachs, J.P. Morgan, Morgan Stanley, Shell, Vitol and Concord Energy have taken equity stakes in the DME, providing the exchange with a resounding vote of confidence by major players in global energy markets.

The DME is a fully electronic exchange, and its contracts are listed on the CME Globex platform, the world’s leading electronic trading platform, providing access to the broadest array of futures and options products available on any exchange. The DME is regulated by the Dubai Financial Services Authority (DFSA) and all trades executed on the exchange are cleared through and guaranteed by NYMEX (a member of CME Group), which is regulated by the U.S. Commodity Futures Trading Commission (CFTC) and is a recognized body by the DFSA.