Over 4,000 enterprises benefit from Tamkeen's finance schemes

Tamkeen announced that more than 4,000 Small and Medium-sized Enterprises have benefitted from its Finance Schemes to date, with a total funding of BD 136 million out of a total funds of BD 189.5 million which are available through various partner banks. These schemes have enabled Bahraini enterprises, especially small and medium enterprises, to acquire the capital they need for growth and expansion through various Shariah compliant financing solutions.

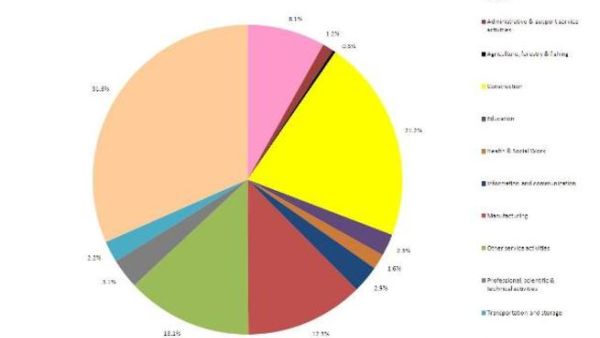

By the end of June, around 4,200 enterprises, mostly SMEs, benefited from the schemes which included more than 1,000 startups and more than 700 micro enterprises. The beneficiaries represent a broad cross-section of sectors and industries within the Kingdom which includes: wholesale and retail trade with 32%, the construction sector at around 21%, professional services at 13%, and accommodation and food services at 8%.

The finance schemes have seen steady growth over the past six-months, with the number of beneficiaries increasing significantly per month. From the beginning of the year until June, the total number of beneficiaries has increased by approximately 25%.

Tamkeen offers these finance schemes in cooperation with 9 local banks, which include: Bahrain Development Bank, Bahrain Islamic Bank, BMI Bank, Al Salam Bank, Kuwait Finance House, Khaleeji Commercial Bank, Standard Chartered Bank, and for Micro Financing, Family Bank and Ebdaa bank. The agreement with the banks aims to bridge the finance gap for many institutions that require the necessary funding for various operational activities.

Tamkeen’s Chief Executive Mr. Mahmood Hashem Al-Kooheji commenting on this milestone said “We are very delighted to see such a great response by energetic Bahraini entrepreneurs that seek to evolve their businesses towards a path of prosperity and sustainability. This milestone of more than 4,000 beneficiaries is proof of catering to the needs of the private sector to ensure overall economic revitalization and development.”

Mr. Abdulla Al Hamar, owner of Auto Spa Cars Centre, was among the beneficiaries of one of Tamkeen’s Finance Schemes. Mr. Al Hamar explained the challenges encountered during the process of setting up his business, and how Tamkeen’s support helped him overcome these challenges and develop the growth of his business as the ultimate destination for cars care solutions.

Mr. Al Hamar also added, “Turning my business idea to a successful business was not an easy process, but thanks to the support provided by Tamkeen, many of the hurdles we faced were lessened. Tamkeen is making enormous efforts to support the private sector, focusing on small and medium enterprises. Therefore, I would advise Bahrainis who are serious about improving their businesses to benefit from the wide variety of programmes provided by Tamkeen.”

Ms. Seema Al Saati, owner of a cleaning services office under the name “Bubbles for cleaning”, received financial support through Her Royal Highness Princess Sabeeka bint Ibrahim Al Khalifa Micro Finance Scheme in cooperation with the Supreme Council for Women which is managed by Ebdaa bank in cooperation with Tamkeen.

She commented: “I thank Tamkeen for supporting my project financially and morally through Her Royal Highness Princess Sabeeka Bint Ibrahim Al Khalifa Micro Finance Scheme which has empowered women economically and facilitated entrance into the job market. They were constantly following my steps, consulting me and advising me which has opened doors for me to look to the future to be bright and visionary”.

Entrepreneurs who have the following documentation available and wishing to benefit from these programmes can visit Tamkeen official website www.tamkeen.bh to see the various financing programmes available

6 months Bank statements.

6 months Electricity bills (paid).

Latest LMRA Bahrainisation Certificate Calculator.

Copy of the enterprise CR or/and license required and the constitutive documents (copy of Partnership Agreement Memorandum and Article of Association), CPR of enterprise owner and any constitutive documents.

Audited Financial Report subject to the bank policy.

Additional documents might be required for any amount equivalent or above BD 50,000 subject to the bank policy.

Background Information

Tamkeen

Tamkeen is a public authority established in August 2006, tasked with supporting Bahrain’s private sector and positioning it as the key driver of economic growth and development. Tamkeen is one of the cornerstones of Bahrain’s national reform initiatives and Bahrain’s Economic Vision 2030.

Tamkeen has two primary objectives - firstly, foster the development and growth of enterprises, and second provide support to enhance the productivity and training of the national workforce. To achieve these objectives -Tamkeen’s 2018-2020 strategy focuses on Diversifying offerings, Accelerate delivery and Sustaining Impact.