The Saudi Arabian Monetary Agency (SAMA) revealed on Sunday that it will be giving banks about SR20 billion (USD5.3 billion) of time deposits on behalf of government entities.

SAMA revealed in its statement that it will continue to adopt its supportive monetary policy through the available mechanisms.

“This policy aims at supporting the domestic financial stability, noting that the banking sector’s non-performing loans did not exceed 1.3% of total loans while coverage exceeded 165% of total non-performing loans and regulatory capital adequacy exceeded 18%,” added the statement.

Reliable sources told Asharq al-Awsat they are certain that the Saudi banking sector will move towards an effective contribution to the economy, at a time when the domestic economy is expected to achieve a new average growth despite the oil sector’s huge losses.

Amid these updates, the Saudi monetary policy, which is aimed at assuring the stability of the Saudi financial regime, is considered the main reason behind the remarkable sustainable growth rates achieved by the country every year.

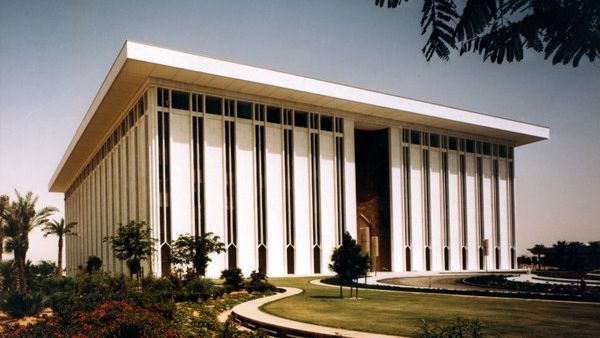

As a strategic goal, Ahmed Al-Khulaifi, governor of SAMA, continued to apply the monetary policies aimed at promoting financial stability.

“In the framework of the rapid development in the economic activities, SAMA has conducted a comprehensive study for payment systems in the kingdom, which resulted in designing a strategy for payment systems for the coming years in order to achieve the visions and aspirations to promote monetary and financial stability, as well as to meet the current and future needs of the domestic market,” said the governor.

According to the governor, the strategy includes four areas: Developing the network system for Saudi payments, providing prepaid cards, setting a development plan for SADAD system and developing the financial transfers system to low-value payments.