It is no secret that the Gulf's oil-rich countries are focused more than ever on earning revenue from non-oil sources, and Saudi Arabia is no exception.

In fact, diversification efforts by Saudi Arabia might be the biggest in the region, considering the scale of the Saudi economy in comparison to its neighboring countries.

While diversification plans were first put in the early 1970s, it can be said that a more serious endeavor has been noticed in the last several years, particularly under the supervision of Crown Prince Mohammad bin Salman, who became the Saudi heir in 2017.

Saudi Crown Prince Mohammed bin Salman speaks during the Future Investment Initiative (FII) conference in a virtual session in the capital Riyadh, on January 28, 2021. Salman said today that the kingdom will sell more shares of energy giant Aramco in the coming years, following the world's biggest public listing in 2019. / AFP / Fayez Nureldine

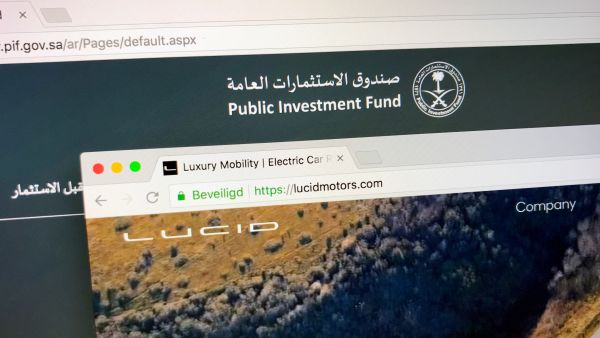

Since then, deals by the country's Public Investment Fund (PIF) have been inked more and more frequently, marking acquisitions on local, regional, and international levels.

Moreover, the PIF has initiated a number of major projects that are fully owned by the government institution, most noteworthy are the NEOM smart city by the Red Sea, in addition to Roshn real estate developer, and the Qiddiya entertainment mega project.

International Investments by PIF

The Saudi Public Investment Fund has signed a total of 12 different deals with a number of international partners, including the French Private Equity Investment, the Investment program in Brazil, and the Russian Direct Investment Fund.

PIF has also acquired shared in a number of leading renowned businesses worldwide, such as investing $3.5 billion in the leading car-hailing app, $1.3 billion in India's Reliance Retail, $20 - $40 billion to US-based Blackstone, Japanese Softbank Group Corp, the $400 million investment in AR Magic Leap Incorporated Company, a $1.5 billion investment in India's Jio Platforms Ltd., $550 million in UK's healthcare Babylon Health, in addition to stakes in Europe's AccorInvest Group.

Moreover, the Saudi Public Investment Fund purchased 61% of the California-based electric car manufacturer Ludic Motors, worth $1 billion in September 2018.

In October 2021, the Public Investment Fund of Saudi Arabia (PIF) acquired around 80% of the Premier league's Newcastle United football club.

Regional Investments by PIF

The Saudi Public Investment Fund has also been eyeing investment opportunities in the Middle East and North Africa, including seven major deals focusing on the banking sector, including investments in Jordan's Arab Bank, Bahrain's Gulf International Bank and ASMA Capital, Arab Bank Switzerland, in addition to the Saudi National Bank (SNB).

The Saudi Public Investment Fund has also acquired 50% of the Kuwaiti Food Co. (Americana).

Local Investments by PIF

Finally, the Saudi Public Investment Fund has been focusing on Saudi business sectors with a variety of industries.

So far, PIF investments in Saudi Arabia are nearing 32 deals, in the energy, real estate, banking, industrial businesses, telecommunications, sports, shipping services, in addition to e-commerce.

This week, the Saudi Public Investment Fund acquired 16.87% of the Saudi conglomerate Kingdom Holding, founded and owned by Saudi Prince Al Waleed bin Talal Al Saud.