ALBAWABA - The Chinese economy is poised to become the globe's top economy, overtaking the U.S. in 2030. The country's GDP is expected to continue growing at a rate of 7 percent annually through 2030. With that kind of growth, Morgan Stanley upgraded its 2023 growth outlook for China, and experts said they anticipate a stronger and earlier rebound.

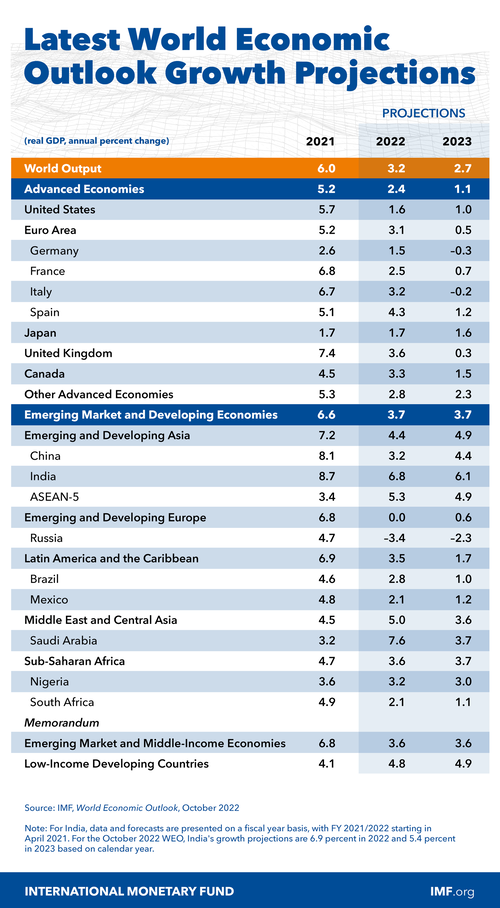

But the rising cost-of-living, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic are taking their toll on the outlook of the global market.

The British consultancy Centre for Economics and Business Research (CEBR) forecasts that China’s GDP should grow by 5.7 percent per year through 2025, and at 4.7 percent annually thereafter until 2030.

But the rapid growth raises many questions about the world’s second-largest economy.

The Chinese economy took off in the early 2000s, when a number of factors converged. But what makes it more dynamic to overtake the U.S. economically? Before answering this question, let’s view some facts and figures about the Chinese economy.

Chinese economy: Facts and figures

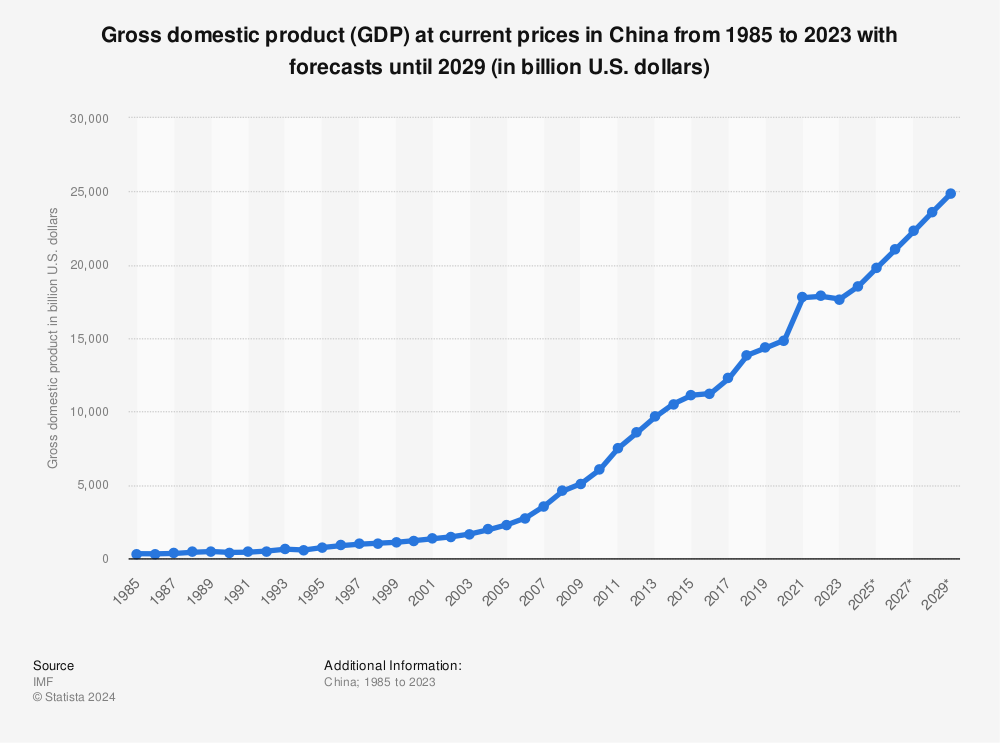

Source: IMF

Since 1978, when China began to open up and reform its economy, GDP growth has averaged more than 9 percent per year, and more than 800 million people have been lifted out of poverty. Over the same time period, there has also been a significant improvement in the public's access to health, education, property ownership, among other services.

In 2022, China's GDP increased by 3.9 percent year on year in the July-September period, according to the national bureau of statistics. Electronics and machinery account for approximately 55 percent of total exports, garments account for 13 percent, and construction materials and equipment account for 7 percent.

While sales to Asia account for more than 40 percent of total shipments, those to North America and Europe average 24 percent and 23 percent, respectively. Despite the rapid growth, exports to Africa and South America account for only 8 percent of the total shipments.

Made in China 2025 Plan

The \stated goals include increasing the Chinese-domestic content of core materials to 70 percent by 2025. The initiative encourages increased production of high-tech products and services to help achieve independence from foreign suppliers, with its semiconductor industry central to the industrial plan, partly because advances in chip technology maybe an advantage that is currently not out of Beijing's reach, said Jordanian economist Zyan Zuwaneh

"China is attempting to spread out and diversify its reliability map, as evidenced by the tens of billions it is investing in the 'Belt and Road' project to build a land, sea, and rail transportation network in order to confirm and increase its presence technologically," Zuwaneh told Albawaba in an interview.

Chinese cars

The Chinese economy's automobile industry began in 1931, when the arsenal of Manchuria's ruler, Chang Hsueh-Liang, displayed its first truck. But experts believe a different date, which is June 15, 1953, is more likely.

The First Automobile Works plant was established at that time, and the production of copies of Soviet trucks was initiated.

Source: motor number

Nowadays, the Chinese auto industry is one of the most flourishing in China this year, as almost half of the new cars presented in 2022 are Chinese.

China's New vehicle manufacturers are gaining traction in international markets as a result of their competitiveness, which stems from their early-mover advantage and rapid adoption of cutting-edge smart technology. According to the China Association of Automobile Manufacturers, vehicle sales this year are expected to increase by 2 percent year on year to 26.8 million units.

In October, China's vehicle exports set a monthly high of 337,000 units shipped overseas. New Electric Vehicles (NEV) accounted for roughly one-third of the total, an increase of 81.2 percent year on year. Europe is a popular destination for Chinese NEV manufacturers such as Nio, BYD, and Xpeng.

China’s Political-economical stance: Russia and Ukraine

President Xi Jinping coined the phrase "Chinese Dream" as his contribution to the Communist Party of China's guiding ideology. Despite its ambiguity, the "Chinese dream" emphasizes people's happiness and the concept of a strong China. The Chinese dream has gone through some ups and downs.

As 2022 unfolded, the deepening of the Sino-Russian alliance in the wake of the war in Ukraine served as a warning showing the true nature of Moscow's relationship with Beijing that is glued by the shared frustration with American global primacy.

But over the time, this lopsided partnership showed that its alpha member is China, as “China took a neutral stance to maintain its trade ties with the U.S. and the west,” another Jordanian economist, Wajdi Makhamra, told Albawaba.

He put to rest doubts that the Sino-Russian partnership constitutes a de facto anti-U.S. alliance. “Because the holistic network of interests that connects Russia and China is deeper than that of the U.S. In addition, threats that are directed from the U.S. to China are much more dangerous than those from the Kremlin, especially due to Taiwan which represents a long-term conflict between China and U.S.," he added in an interview.

"Likewise, China, as a superpower and the world's second economy, is open to everyone, bearing in mind that the volume of trade between China and the US is high, as well as the degree of economic and commercial dependence.”Zuwaneh pointed out.

This reveals a lot about Chinese's leaders' foreign-policy principles and how those ideas may stymie Beijing's efforts to reshape the world order.

Both China and Russia are mutual beneficial trading partners in terms of economics, with China's industrial machine importing Russian oil, gas, coal, and other raw materials in exchange for high-tech Chinese goods. So far this year, total trade between China and Russia has increased by nearly a third to $172 billion.

By contrast, according to the most recent available data, Russia's trade with the United States has dropped by roughly half.

Since the start of the conflict, Beijing has made significant moves to assist Russia in evading sanctions. China has significantly increased its reliance on Russian gas, oil, and coal by increasing its purchases of Russian energy by over 60 percent.

Makhamrah said: “Russia needs China in terms of oil exports and imports, as global markets are closed to Russia, which makes it need an ally of the size of China”. It will be nearly impossible to isolate Russia as long as Beijing positions itself as its biggest client, given that China is the world's largest importer of crude oil and the second-largest importer of natural gas.

Aside from the Ukraine conflict, and regardless of its outcome, the China-Russia relationship is likely to strengthen. Xi and Putin both have a strong desire to reduce their economies' reliance on the United States and its European and Asian partners, and both have a strong incentive to expand trade and investment between their respective economies.

Digital Yuan: Challenging U.S. Dollar dominance

Central bank digital currencies (CBDC) are digital tokens that central banks issue. They are, in some ways, the digital equivalent of cash; their value is guaranteed by a central bank. In order to reduce its reliance on the U.S. dollar-dominated financial system, China is now attempting to gradually erode the dollar's hegemony by leveraging its trade position and stimulating the digital yuan invoicing. Since 2014, the People's Bank of China has been working on a digital version of its national currency.

Makhamrah said the issuance of a digital currency "is in China's best interests, especially if it is accepted and used in commercial transactions."

"The entire world is moving toward digitization, and money is no exception. If the digital yuan is used, China and its economy stand to gain, and the impact of international sanctions imposed on it is mitigated,” he explained.

With access to dollar transactions restricted by US sanctions, Russian businesses are instead turning to the Chinese yuan, advancing Beijing's long-held goal of promoting its currency as a rival to the dollar.

“China and Russia aim to gradually replace the dollar as the primary medium of exchange for international payments over the course of the next ten years. The dollar's decline from its pre-crisis level of 80 percent to its current position was primarily due to the rise of the euro and sterling, with some minor support from the ruble and the yuan. However, it will take many years for China and Russia to reach their goal”.

Although the rate of increase in the percentage of foreign currency reserves denominated in yuan appears to be rapid, it has had a little impact when compared with the rate of increase in reserves denominated in dollars. The dollar accounts for nearly 62 percent of total foreign currency reserves, while the yuan accounts for only 2 percent.

Chinese economy: Challenges

Although China commands a unique niche in the world's political economy—its vast population and large physical size alone make it a powerful global presence—it is still possible to draw general lessons from the Chinese experience for other developing nations. After 3 years of idle economic activity caused by lockdowns under the COVID-19 pandemic, the world lost a significant steam, but the Chinese economy regained some momentum and withered the global economic crisis better than most other countries.

China's GDP growth slowed sharply to 2.8 percent in 2022, from 8.1 percent in 2021, due to multiple domestic and external headwinds. Economic growth has been hampered by widespread Omicron outbreaks and extreme weather. The external environment has also deteriorated significantly since Russia's invasion of Ukraine, with global growth slowing, inflation skyrocketing, and financial conditions tightening.

Nonetheless, the government's tough pandemic measures, the steep property downturn, and cooling export growth will all cause growth to slow down sharply this year. But stronger infrastructure stimulus should help. Downside risks include continued COVID-19 restrictions and a worsening of the property crisis, while an upside risk is the possibility of a tariff rollback in the United States.

China in 2023

As the Chinese government ‘shifts gears’ on zero-COVID, the leadership will prioritize economic recovery in 2023. The usual drivers of Chinese growth—investment and exports—are hobbled by a continuing real estate slump and fading Western demand for Chinese goods, putting the onus on households to do the economic heavy lifting.

Makhamra said: “It wouldn’t take much time for China to regain its industrial momentum."

"The easing of the lockdown measures and the return of economic sectors to growth is expected to be very decisive in the coming back of Chinese economic growth, which will not take long because China is the world's largest producer," he said. "Given the issues plaguing the supply and production chains, I anticipate strong global demand for Chinese products."