Introduction: The World Bank’s ‘Pandemic Bond’

Since 2017 investors have been betting on pandemics through a scheme created by the World Bank. Some of them have made a lot of money. Pandemic bonds were designed by the Bank to move private capital to the world’s poorest countries in the event of a pandemic. But the scheme has failed and seen investors profit and funds delayed.

One report has found that over $114m has been paid back to the private investors in interest. Whilst only $51.4m had been paid to low-income countries by mid-2019. Syria, Yemen, and Djibouti are among the countries promised emergency funds.

Since 2017 investors have been betting on pandemics through a scheme created by the World Bank. Some of them have made a lot of money.

The World Bank’s pandemic bonds illustrate many of the issues facing global health today. As governments around the world have decreased public investment in health care, private capital has been called upon to fill a void. Motivated by profit, the terms of the bonds were so stringent that the quick release of money to the poorest people on earth is yet to arrive in earnest.

Everything in these bonds relies on data. A lack of quality real-time data means funds are either not dispersed or are significantly delayed. Many are now looking to digital surveillance as a solution. But though this might make investors feel safer over their cash, there is little evidence it will help those during a pandemic.

Everything in these bonds relies on data. A lack of quality real-time data means funds are either not dispersed or are significantly delayed.

To start, though, we need to review the Ebola pandemic, the event which led to the creation of the pandemic bonds. One of the problems that occurred during the outbreak of Ebola in Sierra Leone, notably weak medical surveillance, has persisted into other pandemics, including Covid-19. In the meantime, investors have been cashing cheques.

Ebola strikes in Beni, Democratic Republic of the Congo, December 2018 - AFP/Wessels

The Ebola Outbreak and the Difficulties of Tracking Pandemics

The Ebola crisis in west Africa from 2014 to 2017 served as an impetus for the World Bank to look towards new methods of distributing finance towards low-income countries. But the issue of weak surveillance strategies in the initial stages of pandemics has meant that the funds these new methods sought to provide cannot be distributed in time. Digital surveillance has been suggested as a solution, but as the Ebola case illustrates, in the early days of pandemic response systems are rarely in place to accurately assess pandemics in real-time.

In 2014, Ebola spread from Guinea to Sierra Leone and Liberia. By the official end of the outbreak in 2017, there had been 28,600 cases and 11,325 deaths. According to the Center for Disease Control and Prevention, “weak surveillance systems and poor public health infrastructure contributed to the difficulty surrounding the containment of this outbreak and it quickly spread to Guinea’s bordering countries, Liberia and Sierra Leone.” The problems of medical surveillance systems have since plagued the pandemic bond scheme ever since.

In 2014, Ebola spread from Guinea to Sierra Leone and Liberia. By the official end of the outbreak in 2017, there had been 28,600 cases and 11,325 deaths.

Dr Sara Nam, a Technical Expert with Options UK, worked in Sierra Leone at the time. Tracking the virus proved difficult, she told me, in the early stages of the outbreak. “For Ebola, it was not easy to start with. It required, firstly, acknowledgement from the government that there was a problem. Sierra Leone had a good specialist haemorrhagic fever laboratory yet even there, they were not able to test for Ebola, initially.

“There were delays in setting up enough testing facilities. When labs were set up, they were managed by different entities, like NGOs, international government agencies, and with the multiple and new actors who arrived in the health space in Sierra Leone, coordination and communication channels between them took time to be set up. It also took time and skilful negotiations for them to trust one another with open and transparent information.”

Strong medical surveillance systems are what notifies the World Bank that the private capital should be sent to the countries that need it.

Strong medical surveillance systems are what notifies the World Bank that the private capital should be sent to the countries that need it. In 2014 these systems were not available, and they are not available now.

The World Bank Has an Idea

Pandemic bonds were created under the leadership of Jim Yong Kim, then President of the World Bank Group, ahead of the G7 summit in Japan, on 21 May 2016. “This facility addresses a long, collective failure in dealing with pandemics,” Kim said. “The Ebola crisis in Guinea, Liberia and Sierra Leone taught all of us that we must be much more vigilant to outbreaks and respond immediately to save lives, and also to protect economic growth.”

Kim was born in Seoul in 1959 before emigrating to the US, aged 5, with his family.

Kim was born in Seoul in 1959 before emigrating to the US, aged 5, with his family. His father taught dentistry at the University of Iowa whilst his mother earned a doctorate in philosophy. After studying at the University of Iowa and Brown, Kim earned a medical degree at Harvard followed by a PhD in Anthropology. After working in international health, Kim became the president of Dartmouth College before being elected to the president of the World Bank by Barack Obama in 2012.

In an interview with Vice, Kim said that during the ’90s, he was part of the movement to close the World Bank due to widespread mistrust among low-income nations of the Bank’s methods, such as stringent conditions attached to its loans. But he believes things have changed, saying he’s “never seen an institution that has changed as much as the World Bank has changed. We don’t give prescriptions anymore. All the work that we’re doing is done with the agreement of the countries that we serve.”

In an interview with Vice, Kim said that during the ’90s, he was part of the movement to close the World Bank due to widespread mistrust among low-income nations of the Bank’s methods

Kim has said elsewhere that he has always been aware that the World Bank is the most important institution for people who want to help “poor countries develop.” This is, ostensibly, the role of the Bank whose stated mission is to end poverty and build towards a shared prosperity. It was in this spirit that Kim launched the pandemic bonds.

Catastrophe bonds have been around since the 90’s and have generally been successful in sending private capital to countries facing natural disasters. Pandemic bonds work in a similar way. They are, nevertheless, quite complicated.

Firstly, they cannot be considered the same as an ordinary ‘bond’ which is essentially a loan given out, by a country or people, for a designated period of time until a bridge, say, has been built. Whilst the bridge is being built, interest (tokens or coupons) is paid to investors and they make a profit.

Catastrophe bonds have been around since the 90’s and have generally been successful in sending private capital to countries facing natural disasters. Pandemic bonds work in a similar way.

Pandemic bonds, too, involve people buying into an agreement for a specific period. But if certain triggers are met the money is lost to the investor and that cash goes, in theory, very quickly to some of the poorest countries in the world (in the event of a pandemic). It is slightly like insurance, except we normally think of insuring our own house in case of a fire, paying a monthly premium and if a fire occurs going to the insurance company afterwards and asking for monetary value of what we have lost. Pandemic bonds, however, involve third parties selling and buying bonds in case a pandemic occurs in another country. The idea is to move private capital into a space which can help poorer nation-states.

So, if you were to invest in pandemic bonds you would buy into a bond agreement with cash for a certain period, three years in this case. If no pandemics occur, you would be earning interest throughout the time period specified on that bond. Interest can be between 9 and 13% depending on the type of pandemic bond taken out. If a pandemic did occur that triggered the release of the cash, you would never see your money again.

Pandemic bonds, however, involve third parties selling and buying bonds in case a pandemic occurs in another country. The idea is to move private capital into a space which can help poorer nation-states.

The main aim of the bonds is to get money quickly to the places that need it most to help control the spread of the pandemic. At the occasion of the unveiling of the bonds, Kim said that “pandemics pose some of the biggest threats in the world to people’s lives and to economies, and for the first time we will have a system that can move funding and teams of experts to the sites of outbreaks before they spin out of control.

Jim Yong Kim, President of the World Bank /AFP

“Meet Bill Gates and Have Him Pat You on the Back”

Pandemic bonds were oversubscribed by 200%, suggesting investors saw an opportunity to profit. Kim, however, remained positive in the effectiveness of the bonds, saying that “with this new facility, we have taken a momentous step that has the potential to save millions of lives and entire economies from one of the greatest systemic threats we face.”

But the triggers for the funds to be released are so complicated that it seems unlikely that the promise of a quick release of funds can be met. Susan Erikson, Professor of Global Health at Simon Fraser University, has detailed some of the triggers which must be met before funds are released.

Pandemic bonds were oversubscribed by 200%, suggesting investors saw an opportunity to profit.

Amongst them are: the pandemic must have crossed a border, with at least 20 confirmed deaths in the second country; at least 12 weeks must have passed since the start of the event; the total confirmed deaths needs to be at 250 or more; and the growth rate needs to be at a certain percentage.

In order to find out why the triggers were so extensive, I talked to Olga Jonas, a Senior Fellow at the Harvard Global Health Institute. I started by asking her, why did the World Bank start pandemic bonds? “There’s a whole segment of the finance industry that is excited about financial innovations, which can be blamed for the last financial crises in 2008. All these complex derivatives and securities backed by contracts that nobody understands. Too often this innovation covers for incipient fraud,” Jonas told me.

Jonas notes how the lack of regulation over the dealings of the World Bank leave it open to bad dealings. “In every country we have regulations on finance. Very few people study finance and understand it so most people are innocent and so can be easily swindled. That’s the context for innovations – it crosses the line into swindles and fraud. It’s scams. The financial sector is prone to fraudulent advertising. They try to fool people into paying for something that is not true.”

“There’s a whole segment of the finance industry that is excited about financial innovations, which can be blamed for the last financial crises in 2008. All these complex derivatives and securities backed by contracts that nobody understands. Too often this innovation covers for incipient fraud,” Jonas told me.

The context of innovation in finance, then, led to greater complications and opened the possibility for fraud. The financial illiteracy amongst most people who don’t have time to study the subject leaves open vast opportunities for investors to make money. But Jonas argues this is even more so with insurance.

“Insurance has this connotation that it’s a good thing, there’s all this talk of having protection and being safe. So, it’s very emotional, the marketing of it. In all countries insurance is even more regulated than banks or lending. This is because people can be easily fooled into buying insurance that is not needed or is vastly overpriced. 99% of people who buy insurance don’t understand what it is.

“This innovation that the world bank launched was done under the name of insurance. But it’s in a market that is completely unregulated. The World Bank is not subject to any regulations except from its banking transactions. No insurance authority reviewed this insurance deal. The catastrophe bonds are completely unregulated. It’s a shady corner of the bond market. The World Bank was fooling the public and fooling the board in order to get this deal through that would be a flashy innovation.

“They had a $1.3m advertising campaign. The PR was not for what the bond would do and how it would help anybody, but it was ‘look at me, the World Bank President and look at the World Bank, it is innovative, and it is great.’ It went to Davos and the G7 summit.

According to Jonas, the entire motivation behind setting up the pandemic bonds was to “meet Bill Gates and have him pat you on the back.”

According to Jonas, the entire motivation behind setting up the pandemic bonds was to “meet Bill Gates and have him pat you on the back.” As we shall see, the pandemic bonds have failed to provide cash to the countries it was designed to help. Nevertheless, the investors have continued to reap cash rewards through the high-interest rates. The interest payments have been made by taxpayers in Japan and Germany due to their initial backing of the bond, as well as from funds set aside for international aid.

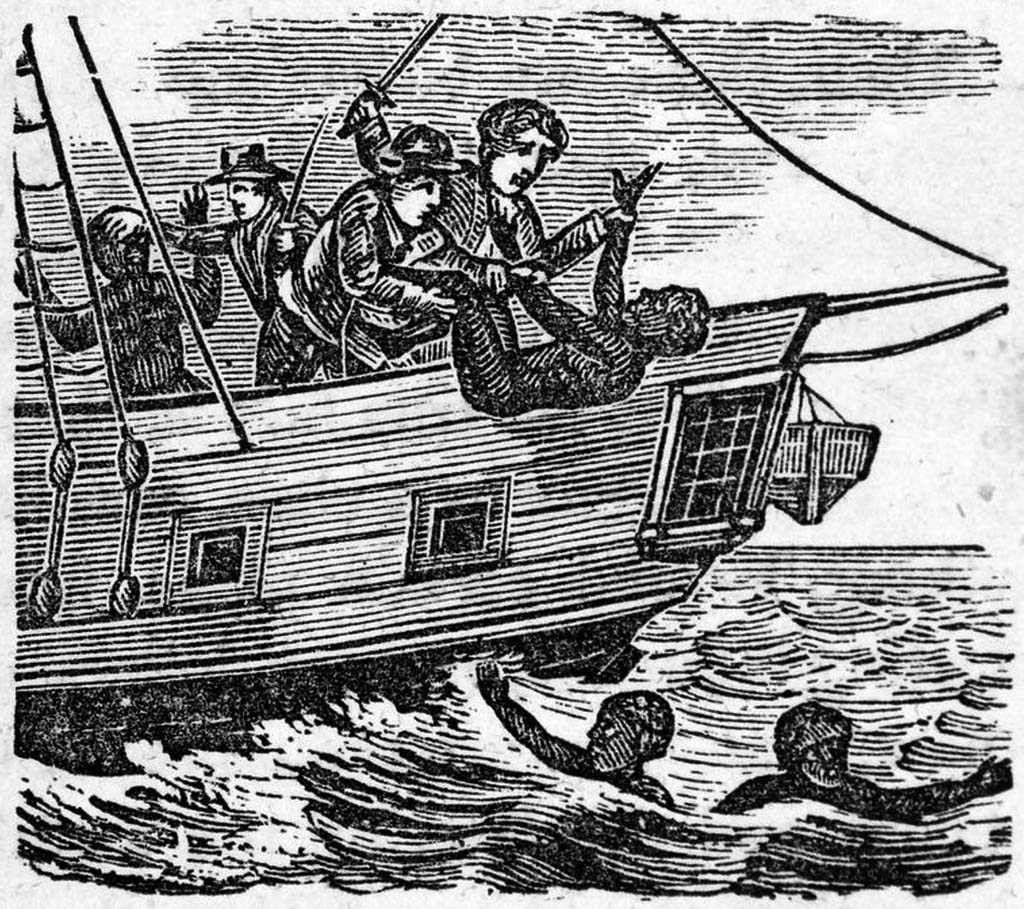

The 'Zong Incident', when 133 African Slaves were thrown overboard to reclaim insurance costs, in November 1781 /Wikimedia

Human Suffering and Profit: A (very) Short History

The practice of insuring other people’s lives is not new. Professor Susan Erikson points out that the Zong incident – where British slavers threw more than 133 African slaves overboard with the knowledge that they could claim ‘lost cargo insurance’ – shows how insurance can be used for malignant ends. “The association between insurance and profit-for-some – who uses insurance for what, why, and how much – is a historied and racist one,” writes Erikson.

Despite Jim Yong Kim’s claim that the World Bank’s work “is done with the agreement of the countries that [it] serve[s],” Erikson found, whilst at a conference with health and national-security officers from all over the world, that the representatives from the countries the pandemic bonds were covering had no idea about the bond’s existence. “We’re not in this. I have never heard of this,” they told her. The practice of ensuring and profiting from the lives of others has continued.

Professor Susan Erikson points out that the Zong incident – where British slavers threw more than 133 African slaves overboard with the knowledge that they could claim ‘lost cargo insurance’ – shows how insurance can be used for malignant ends

Professor Erikson told me that “the bond was designed without consultation with the people who would suffer the most. The PEF insurance was meant for countries that don’t have a lot of resources to fight pandemics. But it makes a difference when the people who will suffer the most aren’t part of the design conversations. The World Bank’s design process favored the investors, not the people or countries who would get the sickest from the lack of critical care.”

Collecting Data During a Pandemic

The terms of the bonds meant that, in the case of Covid-19, funds could not possibly be released until 23 March 2020 which is 12 weeks after the official ‘start’ of Covid-19, on 31 December 2019.

If the criteria are not met 12 weeks after the outbreak begins, they can only be reached if other specific criteria, such as growth rate, are met. However, the pandemic had not reached the criteria set out in the bond agreement and the bonds were not triggered on April 9. The plan of getting cash quickly to low-income countries has failed.

The terms of the bonds meant that, in the case of Covid-19, funds could not possibly be released until 23 March 2020 which is 12 weeks after the official ‘start’ of Covid-19, on 31 December 2019.

The triggering of the bonds is looked after by a private company contracted by the World Bank. Based in Boston, AIR Worldwide specialises in catastrophe modelling; working out the probability that an event will happen based on large and various data points. The triggers were created in consultation with the World Health Organisation, and the reinsurers Munich Re and Swiss Re, and modelled by AIR.

For the pandemic bonds they use various data points to analyse how big the risk is, and in turn how high interest should be for the bonds. However, it’s very difficult to define these requirements, known as parametric triggers, because it’s almost impossible to know how, when, and where a pandemic will start.

The triggering of the bonds is looked after by a private company contracted by the World Bank.

Air Worldwide also collects the data which is used to signify that the requirements have been met for the bonds to be triggered and for the funds to be released. This can pose its own problems. The WHO is the reporting source as it’s seen as the most reliable. These reports are then collected by AIR and put into spreadsheets which track potential and full-blown pandemics around the world.

Doug Fullam, a Risk Analyst for AIR who has worked on the data for the pandemic bonds, spoke with Al Bawaba on the sources they use to show whether the bonds should be triggered or not. “The two formal sources are Disease Outbreak News (DON) and the WHO. The DON will give you a general sense of what’s going on. It’s like two people writing about a baseball game. They can put all the information in; the final score was 5-4. Team A had 10 hits with 1 error and Team B had 7 hits with 0 errors. But maybe one person likes to focus on the processes of the managers, whereas the other likes to look at batting averages. That’s effectively what the DON reports are. They try to present similar data but it’s not necessarily perfect.”

Doug Fullam, a Risk Analyst for AIR who has worked on the data for the pandemic bonds, spoke with Al Bawaba on the sources they use to show whether the bonds should be triggered or not

These reports then need to be combed over by AIR workers who pull out the relevant data as best they can. One major and recurring problem is collecting accurate information on mortality rates. “Every outbreak of any historical size has been underreported. Take, for example, the H1N1 outbreak. There were over 18,000 official deaths but the DCD and WHO now put that in the hundreds of thousands of actual deaths. That’s a difference for 20x,30x,40x.” Mortality rate is highly significant because it is a key requirement for the bonds to be released to the countries that need support.”

All of the data used in the bonds serve different purposes. I called Professor Erikson to ask about the various players involved. “The pandemic bond itself involved over 60 entities. We are talking countries, insurance companies, the World Bank, the UN, the WHO, lawyers, accountants, data modellers, finance modellers. There are a lot of folks involved."

Like Doug Fullam from AIR, Erikson told me about the difficulties of collecting data. “The data that matters in the PEF bond triggers are not necessarily big data. It’s the smaller health surveillance and mortality data. In Sierra Leone, data is collected by a group of short-term contractors called enumerators, who are the data collectors on the ground. It’s mostly men, a few women, who drive to villages and other data collection sites; I’ve travelled with them by motorcycle. Enumerators are the people who go beyond Freetown and may drive 200km to collect death data, which is how far away the area effected by Ebola was. They’re hired by NGOs who are contracted by the WHO. It’s the gig economy, a very ad-hoc scene.

Enumerators are the people who go beyond Freetown and may drive 200km to collect death data, which is how far away the area effected by Ebola was. They’re hired by NGOs who are contracted by the WHO. It’s the gig economy, a very ad-hoc scene.

“There are huge problems with actually getting accurate data, as we saw with Ebola, there are 13 different languages spoken in Sierra Leone, an area the size of Scotland. Enumerators might speak different languages than those spoken in their data collection area. Just because somebody is Sierra Leonean doesn’t mean they’d be welcome in a village that is suffering from Ebola or Covid. In Sierra Leone, getting accurate numbers is hard, it’s physically and mentally demanding work. And even if enumerators can collect data, some hotspots have no cell phone coverage and they can’t send their data out. There are many administrative problems.”

Erikson insists that data has different meanings to different people. For investors, the data will tend to signify how risky an investment is. The risk itself is a “moving target,” she says, depending on the other variables in the market and the situations around the world. This comes down to what type of risk are investors willing to take in the expectation of making a profit.

For investors, the data will tend to signify how risky an investment is. The risk itself is a “moving target,” she says, depending on the other variables in the market and the situations around the world.

“What level of investment risk is palatable to the people who buy the pandemic bond? The answer is hugely variable depending on how much money is available and what kind of investment vehicles people are trying to put money into. The bond was created to diversify investment options, to open up a new place to invest. Health data in this environment is a means to the ends of creating new places to park money. How health data will be used in future instruments may be different yet again,” Erikson tells me.

The complexity of the triggers and the difficulty inherent in gathering the data meant that triggering the release of the funds could not be done quickly enough to provide relief to those struggling to fight Covid-19. The fact the information doesn’t necessarily reflect the situation on the ground means that factors such as mortality rate and the international spread of the virus may mean that data is severely out of date by the time it is analysed.

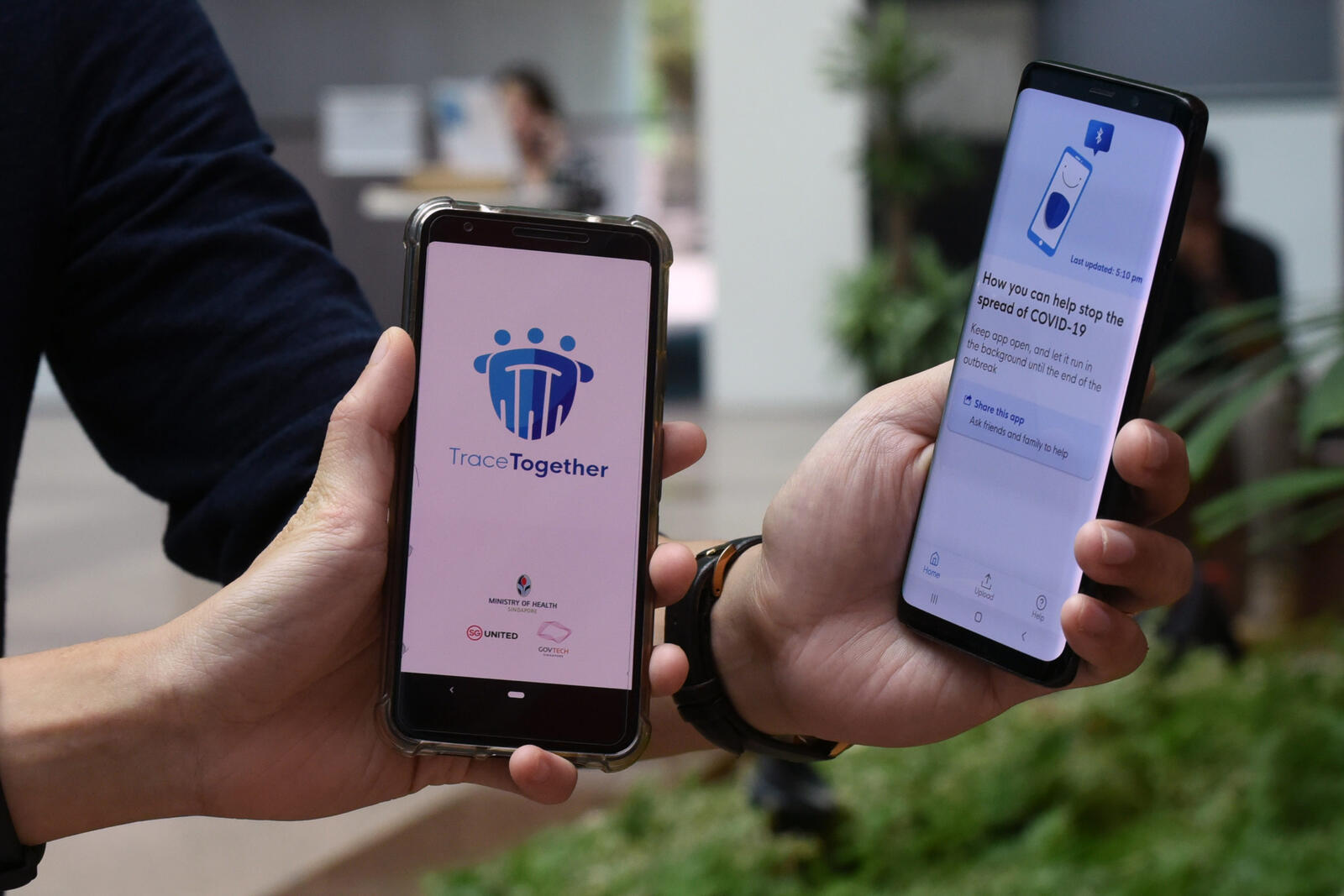

Singapore's new contact-tracing smarthphone app called TraceTogether, March 20, 2020 /AFP

A Digital Solution?

At the time of writing, the pandemic bonds have been triggered for Covid-19 and $195.84 million USD in funds has finally been released. With at least 300,000 global deaths, the bonds’ promise of delivering quick funds to low-income countries has fallen through. In response, some are looking to digital surveillance to provide real-time data at greater speeds. The hope is that this can trigger the release of funds earlier as more up-to-date information comes through to the World Bank.

The pandemic bonds have been triggered for Covid-19 bit funds are yet to arrive.

Steve Evans is the owner and editor-in-chief of Artemis and Reinsurance News. He’s in favour of the use of catastrophe bonds and told me that the pandemic bonds were received positively by investors when they were unveiled. “From the investors point of view, it was a new kind of peril that they were interested in. It takes some time for people to get used to the type of risk, but I understand that’s always the same with something that’s new and hasn’t been in the market before.” Evans told me that it took time for investors to get comfortable with the modelling and to conduct their own modelling before they were confident in assuming the pandemic exposure.

The Gateway Podcast, with Ty Joplin.

Evans says that parametric triggers, an agreement whereby a certain amount of money is paid when specific parameters are met, irrespective of the financial loss, are paid out quickly compared with other types of insurance. “If you had done this as a traditional indemnity-based insurance contract you could have been waiting for years for a pay-out.”

“If you had done this as a traditional indemnity-based insurance contract you could have been waiting for years for a pay-out.”

In terms of data collection, Evans points to other insurance products that can deal with natural disasters in almost real-time. “There are companies out there, like FloodFlash, that are measuring flood depth with sensors for parametric triggers and they can pay out within 24 hours.”

Real-time data is often seen as the best way forward when it comes to giving quick and responsive payouts. Evans suggests that “Sensors are the future. For example, if everybody had a pandemic tracking app, which obviously has implications around privacy, then potentially you could structure a policy based on something like that, using the big data sensors generated to construct triggers. There’s always going to be better ways to design these things going forward as the technology improves.”

However, collecting digital data in low-income countries is just as difficult as in medium or high-income countries. There are concerns around data and subsequent manipulation by private or public bodies. Those aside, it might not be realistic to see digital surveillance as a golden gate to perfect pandemic tracking.

“Sensors are the future. For example, if everybody had a pandemic tracking app, which obviously has implications around privacy, then potentially you could structure a policy based on something like that"

Dr Stephen L. Roberts is a Fellow in Global Health Policy at the London School of Economics (LSE). Roberts says that the marriage of big data and digitisation with pandemics is more established than in higher-income countries, such as the US or UK. Nevertheless, trust in public institutions is vital if the data is to be accurate. “Contact-tracing apps work best when there is a transparent culture that enables the population to have continued trust in the public health authorities and in the responding governments.”

Studies of Ebola in Sierra Leone have found that there was an initial mistrust of health workers and the government in the early stages of the outbreak. During extreme times, such as a pandemic, an underlying government mistrust is likely to be heightened. In Sierra Leone, for instance, rumours circulated that the first cases of the disease were caused by the government attempting to kill communities in opposition areas. Such mistrust is likely to lessen the chances of widespread virus-tracing apps and so show lower levels of the virus amongst a population. This, in turn, means triggers would be met later for pandemic bonds than the actual situation on the ground would suggest.

“If you reduce the human experience or health conditions to a data point, then you lose all of the really critical, sociological and anthropological aspects in understanding the virus

“Contact tracing apps can provide a lot of insight and they can give a lot of understanding, but they need to be consistently paired in with public trust and public engagement in order for them to function at their most optimal during outbreaks,” Roberts says.

There are other, more fundamental problems, with pushing for a more digital and data driven approach which Roberts points out. “If you reduce the human experience or health conditions to a data point, then you lose all of the really critical, sociological and anthropological aspects in understanding the virus. If you reduce it to a data point, it’s very hard to understand the experiences that led to an individual falling ill.

What are the conditions which led, not this data point, but the human the virus lived in? Who does she interact with? What are the conditions which were successful or unsuccessful in having her contract and fall ill with the virus? What are the political and economic arrangements that the individual finds themselves in – regarding work, economy, income, social relations – that enabled the virus to thrive?”

Wuhan province china, AFP

What Now?

Pandemic bonds have failed. Seeking to address one problem, the need for quick support in low-income countries during the early stages of pandemics, the structure of the bonds neglected to account for difficulties in medical surveillance and, as such, predestined their own failure within their design. The bonds can only work if the places it seeks to support have high capabilities of tracking viruses.

Pandemic bonds have failed.

But, medical surveillance wasn't sufficient in the early stages of Ebola, nor was it in the early stages of Covid-19. Regardless of the ethical problems inherent in the bonds, if they are to work in the future the World Bank needs to ensure, in conjunction with other institutions and governments, that it’s possible to quickly understand the scale and spread of pandemics. This doesn’t mean relying wholly on digital surveillance.

Since the bonds were triggered for Covid-19 on 17 April, the payment of funds were delayed until 15 May. According to Olga Jonas, this means investors have been paid between $2 and $2.5m in interest payments during the month-long delay.

It means investing in systems that focus on the virus as it’s experienced by individuals and communities, and not by data points. Without sufficient methods of tracking viruses in low-income countries, the bonds will not be released and investors will continue to profit.

Since the bonds were triggered for Covid-19 on 17 April, the payment of funds were delayed until 15 May. According to Olga Jonas, this means investors have been paid between $2 and $2.5m in interest payments during the month-long delay.