Lebanon’s half-absent electricity remains a major source of social and financial distress for the country. Despite the national electricity company’s (Electricite du Liban, or EdL) failure to supply enough power since the 1990s, the government’s divergent parties could not agree on a rehabilitation or a privatization plan. Instead, the government restricted its role to a draining, indefinite annual financing of more than 90 percent of EdL’s purchases of fuel at a fat bill of $1.8 billion. The market meanwhile was left to its own devices. Between private generators, consolidated electricity generation, sleazy borrowing and investments in alternative energies, Lebanese citizens are almost getting by, but not without terrible costs on wealth and health.EdL’s combined capacity to generate electricity stands at 1,800 megawatts, falling short of the actual demand by around 1,600 MW, which is currently filled by unregulated private generators.

Although closely linked to GDP output and income growth, which have been ill-growing in Lebanon since the beginning of the crisis in Syria (real growth averaged 1.7 percent in 2011-15), demand for electricity continued to grow in Lebanon, coming more from individual than industrial use.

Typically in times of recession, households tend to buy smaller houses – confirmed by recent real estate trends in Lebanon – and therefore use electricity less, and purchase fewer electrical appliances. However, no such decrease was noted, presumably due to the prevalence of private power generators which supply electricity against fixed amounts per amperes rather than according to actual usage, giving fewer incentives for households to rethink consumption. Moreover, an actual increase in demand came with the settling of around 2 million Syrian refugees in the country during the past five years.

On the other hand, demand for electricity from Lebanese industries stabilized during the past few years. The World Bank estimates the industrial sector’s usage of electricity at around 60 percent of total consumption, with large-scale manufacturers relying on their own generators to ensure an uninterrupted current. Losses from intermittent electricity, the tariff structure of private generators and self-sufficiency ventures all tighten profit margins, and contribute to a loss of competitiveness in pricing and exports.

Dr. Fadi Gemayel, president of the Association of Lebanese Industrialists, notes that the average energy factor cost is 5.7 percent of companies’ selling price, but it reaches as high as 35 percent for energy-intensive industries, mainly manufacturing sectors such as plastics, paper, glass, steel and others, adding to the challenges and tough operating conditions of industrialists in Lebanon.

Despite the lack of studies on sectors’ energy consumption, the ones depending directly on electricity, mainly manufacturing, contribute to 11 percent of Lebanon’s GDP, and represent 15 percent of the country’s exports. The deteriorating economic situation and the complications arising from the Syrian war have already led to a whopping 54 percent fall in exports between 2011 and 2015, totaling $2.9 billion last year. An additional decrease of 5.6 percent was recorded as of July 2016.

The economic indicator BLOM PMI, or purchasing managers’ index, has been showing continuous declines in the private sector’s activity, with output taking the hardest hit while input costs remaining stickily high. By August 2016, the output’s index was the lowest among the other indexes, at 41.5. Meanwhile on the cost side, and despite generally lower oil prices and cheaper foreign currencies, overall input costs at Lebanese companies remained above 50, the neutral point, reflecting the companies’ trouble at contracting their costs proportionally to the decrease in demand, thus leading to lower profits.

Regular power cuts and intermittent supply are not only a daily annoyance and work disturbance, the inefficient power company is also causing direct losses on the macro level. Subsidies to this sector are wearing out the government’s budget, deterring spending on more efficient infrastructure and heightening the public debt.

During the period 2011-2015, a total of $9.2 billion was spent to cover the fuel purchases of EdL, an average of $1.8 billion per year, or 3.8 percent of GDP. The government posted a budget deficit of $3.5 billion in 2015. The recent lower oil prices have contributed to a lower annual bill of $1.1 billion in 2015, reducing the burden of electricity from 21 percent of current expenditures in 2014 to 12.8 percent of current expenditures in 2015, but it still occupies the largest weight on the government’s budget after debt service and public wages.

Many experts question the use of transfers made to a company failing to cover more than 50 percent of market demand. The substantial government subsidies target only EdL’s current expenses, which can be expected to continue indefinitely and fluctuate according to oil prices.

The revenues collected by EdL through the three main contracted distributors, BUTEC, KVA, and NEU, remain a mystery. There are no public figures regarding EdL’s financial standing, nor audit reports. The only indication available for EdL’s current funds is its own contribution to the bill of oil imports, $25 million in 2015.

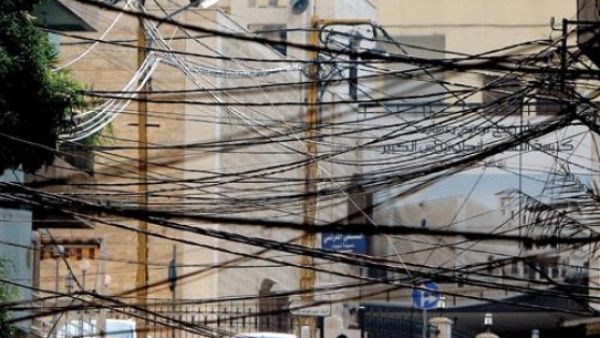

Naturally, the market has responded with some creative solutions, but not without negative implications. The private power generators were the first to emerge and live off the electricity crisis. Tariffs of private generators remain uncontrolled and unregulated, and are set randomly despite a general weekly pricing guidance published by the government. Bills from generators are more than double EdL’s, but contrary to EdL’s bills, they are efficiently collected with no recorded problems. The ecological footprint of these generators has yet to be studied.

The privatization of the electricity company faces political blockades. Recently, however, the private sector came back in more robust ways. Electricite de Zahle (EdZ), independently generating electricity for Zahle and its neighboring towns, promised and delivered constant current by replacing all private generators with one power station supplying electricity to consumers. The impact of the new model on households was very positive, but less so on industrialists. Households’ bills were reduced as electricity was billed according to usage based on smart meters instead of the “by ampere” system applied by private generators. Industrial companies, however, found the system more costly, especially that the tariff wasn’t based on a progressive consumption basis. Several industrial sources in Zahle confirmed moving back to their own generators to ensure continuous operations, and many are studying the use of solar power and other alternative energies to reduce their costs.

The World Bank recommends that electricity costs should not exceed 10-15 percent of the household’s disposable income. Although no estimates are available for households’ disposable income in Lebanon, a survey by the Central Administration of Statistics on households’ expenditures in 2012 found that a Lebanese family of four spends on average $2,000 per year on electricity bills. This is no doubt high by international standards, especially in a country whose per capita income averaged $7,140 in 2014.

Perhaps the government should start looking more seriously at consolidating the generator market, a step that may have the cost of rendering several investments obsolete. However, once the Lebanese citizen trusts the 24/7 electricity promise, raising EdL’s tariffs may become less controversial, especially that oil prices are forecasted to remain low.

The government should also tend to initiatives similar to EdZ by regulating the licensing process and standardizing operating conditions, taking into account the needs of citizens and industrialists alike. Uncostly procedures for the government also include improving collection, unifying and monitoring price lists, and requiring smart meters and isolated electric rooms in new buildings.

In the meantime, one of the most hailed solutions remains power generation from renewable energies. Renewable energy options in Lebanon start with tides and waves, geothermal energy, solar energy, wind energy, hydropower, and don’t end with biomass and energy from nonseparated waste – a double-score solution as it also resolves part of the ongoing waste crisis. However, these resources are barely used. Power generation in Lebanon is mainly concentrated around thermal energy production, and hydropower does not exceed 4.5 percent of total generation capacity.

The generation of electricity through renewable sources is also an encouraged investment. The Central Bank subsidizes loans in this field, and many international funding organizations such as the Internaional Finance Corp., the World Bank and the European Investment Bank are well-poised to contribute through loans and equity alike.

The government cannot leave this ship to sink. If allocating funds for investments in this sector to rehabilitate the plants or increase them adds burden to a deficit already worn out by the operational transfers, it may be time to regulate and encourage private sector initiatives. This will ensure at least the basic need for continuous electricity at affordable costs to citizens and companies, and relieve the government budget to benefit other urgent reforms. All these short- and medium-term solutions don’t waive the necessity of putting a long-term plan in place. In this regard, some form of a private-public partnership is most recommended, taking into consideration the possibility of the production of gas from Lebanon’s offshore.

This monthly editorial is brought to you by the Research Department of BLOMINVEST BANK