Boursa Kuwait Announces Profits of KD 11.7 Million for the Period Ended 30 September 2021

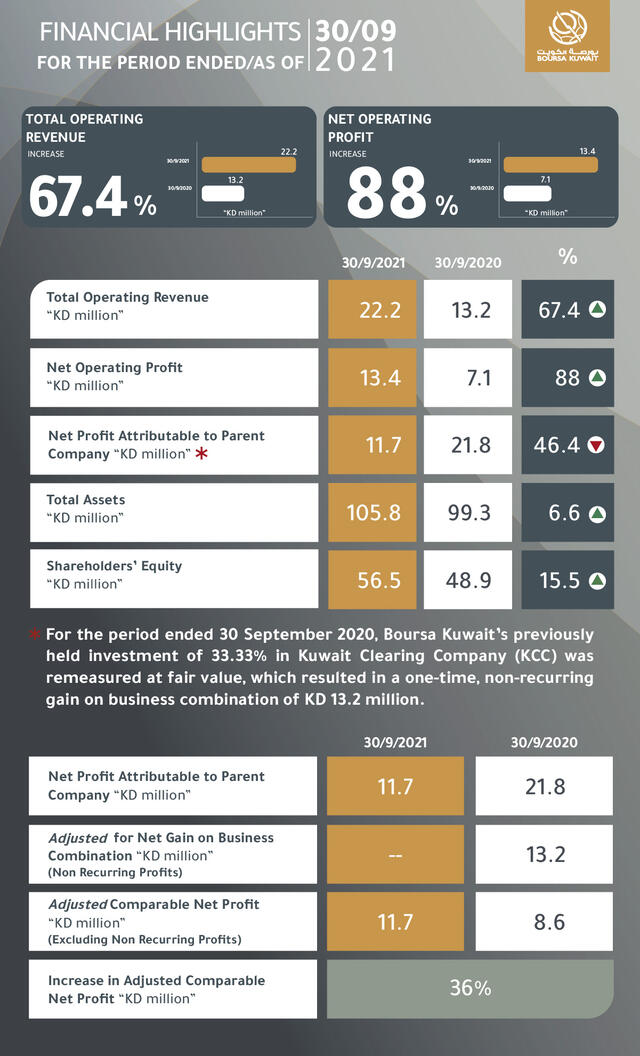

In a meeting of its Board members on 1 November 2021, Boursa Kuwait announced that total operating revenue came in at KD 22.2 million for the nine-month period ended 30 September 2021, an increase of 67.4% compared to the same period in 2020, when the total operating revenue was approximately KD 13.2 million. Net operating profit also increased, by almost 88%, from KD 7.1 million to KD 13.4 million. The robust performance was underpinned by the strong operational performance reflected in key performance indicators, including a 45.6% increase in value traded and a 65.9% increase in volume traded for the nine-month period ended 30 September.

The company also announced net profits of KD 11.7 million for the nine-month period ended 30 September 2021. Due to the conversion of the investment in Kuwait Clearing Company (KCC) from an associate to a subsidiary during the third quarter of 2020, a remeasurement of Boursa Kuwait’s existing shareholdings in KCC resulted in a one-time gain on business combination of around KD 13.2 million that contributed to the net profit of KD 21.8 million for the period ended 30 September 2020. Adjusting for the one-time gain on business combination, net profit shows robust organic growth of approximately 36% from KD 8.6 million to KD 11.7 million.

The consolidation of KCC also resulted in a 43.3% increase in total operating expenses from KD 6.1 million to KD 8.7 million. This is mainly because KCC’s expenses were consolidated for the entire nine-month period in 2021 while expenses were consolidated for the period after 30 June in 2020.

Meanwhile, Boursa Kuwait’s total assets stood at approximately KD 105.8 million as of 30 September 2021, which is a 6.6% increase versus 2020 total of KD 99.3 million as of 30 September 2020. Shareholder equity attributable to the equity holders of Boursa Kuwait increased from KD 48.9 million on 30 September 2020 to KD 56.5 million as at 30 September 2021.

Boursa Kuwait Chairman Mr. Hamad Meshari Al-Humaidhi commented: “We are pleased to have recorded profits of KD 11.7 million during the nine-month period ended 30 September 2021, with a marked improvement in key performance indicators, exhibiting Boursa Kuwait’s financial strength, its flexible operational model, as well as its innovative and adaptable strategy.”

Al-Humaidhi added: “Boursa Kuwait continues to support the national economy, and remains committed to the implementation of environmental, social and governance policies and principles as part of its Corporate Sustainability strategy, which is in line with the United Nations’ Sustainable Development Goals (SDGs) and the National Development Plan “New Kuwait 2035”. I would like to thank my fellow Board members, the Executive Management team, and all Boursa Kuwait employees for their invaluable efforts to enhance the company and the capital market.”

Mr. Mohammed Saud Al-Osaimi, Boursa Kuwait’s Chief Executive Officer also commented on the company’s quarterly financials, saying, “Boursa Kuwait has seen a marked increase in trading value and volume, which is undoubtedly a reflection of the increasing confidence of investors from all over the world. The company has also seen tremendous growth in its operating revenue, a reflection of our ongoing commitment to develop a strong financial market with high liquidity and credibility that enhances the position of the exchange in the region and helps transform Kuwait into a global investment destination.”

Boursa Kuwait aims to develop a strong financial market with high liquidity and credibility through the implementation of a range of structural and technical developments and initiatives that will enhance the position of the exchange, regionally and globally. The company continues to implement many steps in accordance with international practices and standards by focusing on creating an attractive issuer base and broadening its investor base, increasing the depth and breadth of its products, as well as upgrading its infrastructure and business environment, and recently welcomed the listing of three companies from the Industrial, Real Estate and Financial Services sector on its “Main” Market.

Since its inception, Boursa Kuwait has worked diligently to create a credible exchange built on efficiency and transparency, creating a liquid capital market, a progressive exchange platform and developing a comprehensive set of reforms and enhancements that allow it to compete on an international level. Over the past five years, the company has rolled out numerous market reforms and new initiatives as part of its comprehensive multi-phase market development (MD) plans.

Background Information

Boursa Kuwait

Boursa Kuwait was founded on April 21st, 2014 by the Capital Markets Authority Commissioners’ Council Resolution No. 37/2013 dated 20th November, 2013 and the Capital Markets Authority Law No. 7/2010. In addition to being primarily responsible for regulating all aspects of the Kuwaiti capital market, the Capital Markets Authority also has full ownership of Boursa Kuwait, which manages the exchange operations. Boursa Kuwait is responsible for introducing new trading rules, risk management practices, price discovery mechanisms and new technology to ensure that Boursa Kuwait is as robust and secure as possible. The establishment of Boursa Kuwait marked the first step in privatizing the Kuwaiti Stock Exchange, which was founded in 1983.