DME Auctions: November Oman Cargo Sold at Osp +$0.18

Oman’s Ministry of Oil and Gas (MOG) sold a cargo of Oman blend crude via DME Auctions, achieving a strong premium above the Official Selling Price (OSP) which reflects the current strength of the Middle East crude oil market, particularly in Oman.

The 2-million-barrel cargo of November-loading Oman Blend crude was awarded at a premium of $0.18 per barrel over the November OSP.

The DME Auction platform saw 16 participants take part in the auction with 29 active bids placed during the 2-minute period. The Oman OSP is calculated on a volume-weighted average of daily DME Oman Crude Oil (OQD) Marker Prices over the month.

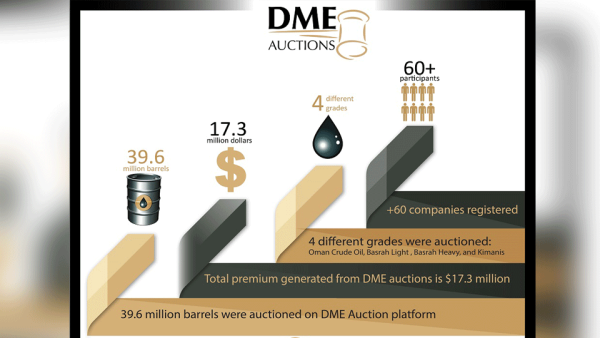

Raid Al-Salami, Managing Director, DME, said: “The continuous success of DME auctions underlines the need for a robust and transparent mechanism to buy and sell spot cargoes. The platform has auctioned 39.6 million Barrels from 4 different grades including Oman Crude Oil, Basrah Light, Basrah Heavy and Kimanis and generated premiums of $17.3 million above the official selling price.”

Background Information

Dubai Mercantile Exchange

The Dubai Mercantile Exchange Limited (DME) is the premier international energy futures and commodities exchange in the Middle East, providing a financially secure, well-regulated and transparent trading environment.

The DME is majority owned by core shareholders Tatweer (a subsidiary of Dubai Holding), Oman Investment Fund and CME Group. Global financial institutions and energy trading firms such as Goldman Sachs, J.P. Morgan, Morgan Stanley, Shell, Vitol and Concord Energy have taken equity stakes in the DME, providing the exchange with a resounding vote of confidence by major players in global energy markets.

The DME is a fully electronic exchange, and its contracts are listed on the CME Globex platform, the world’s leading electronic trading platform, providing access to the broadest array of futures and options products available on any exchange. The DME is regulated by the Dubai Financial Services Authority (DFSA) and all trades executed on the exchange are cleared through and guaranteed by NYMEX (a member of CME Group), which is regulated by the U.S. Commodity Futures Trading Commission (CFTC) and is a recognized body by the DFSA.