Mashreq and Arady Properties launch the UAE’s first Qualified Investment Real Estate Fund

UAE’s leading financial institution, Mashreq is in partnership with Arady Properties, an experienced Real Estate company set to launch the UAE’s first Qualified Investor Real Estate Fund which will be registered in the DIFC.

The Sharia’h Compliant fund’s strategy will be the acquisition of select, income generating, diversified assets across the GCC with a focus on the United Arab Emirates. The investment vehicle is structured as a six-year, close-ended fund, regulated by the DFSA. It will deploy USD 300 million of equity paired with debt to acquire assets with strong yielding potential. Capital raising and the Fund Road Show will commence in Q3, and will consist of three, $100 million tranches amongst a maximum of 50 investors.

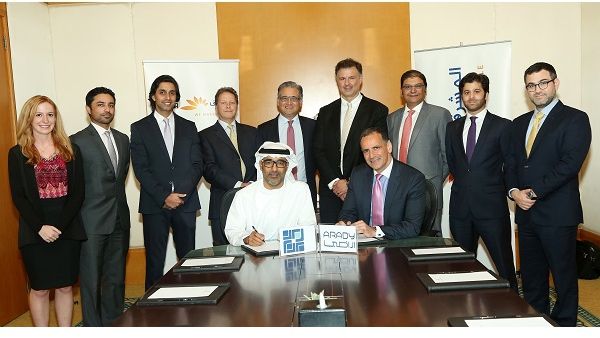

The partnership was signed by John Iossifidis, Group Head of Corporate Investment Banking Group at Mashreq and Ali Hamad Lakhraim Al Zaabi, Chairman of Arady Properties.

The Fund’s objective will be to provide attractive returns to investors through acquisition of assets with substantial upside via active property management. Assets will be selected by leveraging the Fund’s extensive network and management’s industry expertise. The current market conditions present an opportune time to acquire targeted assets in the UAE with many GCC investors having significant capital seeking stable investments delivering optimal returns through robust management capabilities.

Mashreq’s Real Estate Finance and Advisory team has spearheaded the Funds initiative and will act as an investment advisor along with Arady, whilst Mashreq Capital will act as the Fund Manager, an award winning institution with four Funds under management.

Arady Properties is a well-established investment manager with substantial regional experience in real estate private equity, asset management, and investment advisory. The JV partnership will bring significant industry expertise, unparalleled market knowledge, access to lucrative assets and a plentiful investor base.

On the launch of the Fund, John Iossifidis, Group Head of Corporate and Investment Banking at Mashreq, stated: “This Fund will add a significant amount of Product and Investment diversity to the region’s Real Estate and Asset Management platforms. This is further evidence of Mashreq’s market leading capabilities in the area of Real Estate Finance & Advisory.”

Ali Hamad Lakhraim Al Zaabi, Chairman of Arady Properties, expressed: “Arady Properties is delighted to partner with Mashreq in this pioneering initiative and is looking forward to contributing our industry expertise, market knowledge and extensive investment experience.”

Zain Qureshi, Head of Real Estate Finance and Advisory at Mashreq, said “We believe this is an ideal time to launch such an investment product; we look forward to working with our partners and enhancing our contribution to the GCC real estate market. Other avenues and structures are currently being developed by the Real Estate Finance & Advisory team which will continue to keep this platform a market leader.”

Background Information

Mashreq

Mashreq has provided banking and financial services to millions of customers and businesses since 1967.

We are one of UAE's leading financial institutions with a growing retail presence in the region including Egypt, Qatar, Kuwait and Bahrain. We focus on providing our customers access to a wide range of innovative products and services.