NetApp Reports Fourth Quarter and Fiscal Year 2019 Results

NetApp (NASDAQ: NTAP) reported financial results for the fourth quarter and fiscal year 2019, which ended April 26, 2019.

“Despite the modest shortfall relative to our fiscal year 2019 expectations, we made significant progress in the strategic markets of all-flash, private cloud, and cloud data services. Our Data Fabric strategy clearly differentiates us from our competitors,” said George Kurian, chief executive officer. “Enterprises are choosing NetApp to be a strategic partner in their digital transformations. Our opportunity is large and growing, and we are moving quickly to improve our execution.”

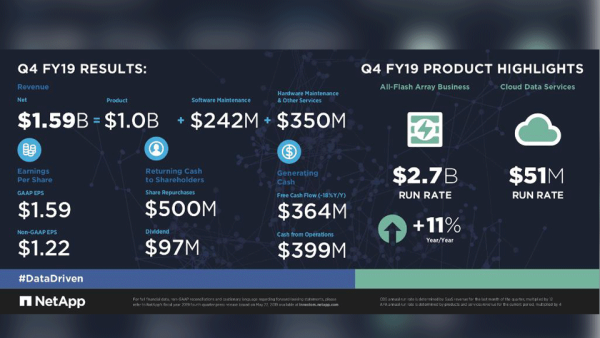

Fourth Quarter Fiscal Year 2019 Financial Results*

- Net Revenues: $1.59 billion, compared to $1.64 billion in the fourth quarter of fiscal 2018

- Net Income: GAAP net income of $396 million, compared to GAAP net income of $290 million in the fourth quarter of fiscal 2018; non-GAAP net income1 of $305 million, compared to non-GAAP net income of $307 million in the fourth quarter of fiscal 2018

- Earnings per Share: GAAP net income per share2 of $1.59 compared to GAAP net income per share of $1.06 in the fourth quarter of fiscal 2018; non-GAAP net income per share of $1.22, compared to non-GAAP net income per share of $1.12 in the fourth quarter of fiscal 2018

- Cash, Cash Equivalents and Investments: $3.9 billion at the end of fiscal 2019

- Cash from Operations: $399 million, compared to $494 million in the fourth quarter of fiscal 2018

- Share Repurchase and Dividend: Returned $597 million to shareholders through share repurchases and cash dividends

Fiscal Year 2019 Financial Results*

- Net Revenues: $6.15 billion, increased 4% year-over-year from $5.92 billion in fiscal 2018

- Net Income: GAAP net income of $1.17 billion, compared to GAAP net income of $116 million** in fiscal 2018; non-GAAP net income of $1.17 billion, compared to non-GAAP net income of $983 million in fiscal 2018

- Earnings per Share: GAAP net income per share of $4.51, compared to GAAP net income per share of $0.42** in fiscal 2018; non-GAAP net income per share of $4.52, compared to non-GAAP net income per share of $3.56 in fiscal 2018

- Cash from Operations: $1.34 billion, compared to $1.48 billion in fiscal year 2018

- Share Repurchase and Dividend: Returned $2.51 billion to shareholders through share repurchases and cash dividends

*In the first quarter of fiscal 2019, NetApp adopted Revenue from Contracts with Customers (ASC 606) using the full retrospective method of adoption. Accordingly, NetApp’s condensed consolidated balance sheet as of April 27, 2018, condensed consolidated statements of operations and cash flows for all fiscal 2018 periods presented, and all related financial statement metrics included herein, have been restated to conform to the new rules.

**On December 22, 2017, the Tax Cuts and Jobs Act was enacted into law. This tax reform legislation contains several key tax provisions that affected the company, including a one-time mandatory transition tax on accumulated foreign earnings and a reduction of the U.S. corporate income tax rate to 21% effective January 1, 2018, among others. GAAP net income in fiscal year 2018 was impacted by a resulting one-time charge of approximately $850 million.

First Quarter Fiscal Year 2020 Financial Outlook

The Company provided the following financial guidance for the first quarter of fiscal year 2020:

|

$1.315 billion to $1.465 billion |

|

|

GAAP |

Non-GAAP |

|

|

$0.56-$0.64 |

$0.78-$0.86 |

Full Fiscal Year 2020 Financial Outlook

The Company provided the following financial guidance for the full fiscal year 2020:

|

||

|

GAAP |

Non-GAAP |

|

|

63%-64% |

64%-65% |

|

20%-21% |

23%-24% |

|

||

Dividend

The Company will increase the first quarter fiscal year 2020 dividend by 20% to $0.48 per share. The quarterly dividend will be paid on July 24, 2019, to shareholders of record as of the close of business on July 5, 2019.

Fourth Quarter Fiscal Year 2019 Business Highlights

New Products Enable Digital Transformation

- NetApp announced a variety of new and updated offerings that give customers more flexibility across hybrid multicloud environments for a range of use cases, including FlexPodTM AI platform; FlexPod for MEDITECH software; NetAppTM Service Level Manager; and the FlexCacheTM.

- OnCommandTM Workflow Automation 5.0 makes it easier for customers to automate, monitor, and maintain storage workflows. Changes in the web UI deliver a consistent user experience across OnCommand System Manager, Unified Manager, and Workflow Automation, resulting in improved simplicity and efficiency.

Industry-Leading Strategic Partnerships

- Intel Optane DC Persistent Memory and NetApp Memory Accelerated Data extended their partnership to help customers realize the promise of solutions that offer shorter time to results with their data.

- NetApp partnered with H2O.ai and integrated NetApp Cloud Volumes Service, a cloud-native file storage service. H2O Driverless AI provides a platform for customers to collaborate, scale, and deploy AI solutions more quickly.

- Texas-based Soccour Solutions received HCI Champion Partner status after it embraced NetApp HCI as part of its customer offerings.

Industry Recognition

- NetApp was named 2018 Google Cloud Technology Partner of the Year for Infrastructure at the Google Cloud Next 2019 Partner Summit.

- NetApp was awarded Brand of the Year by Think Global Awards, which recognizes achievements in promoting an awareness of thinking globally for individuals, communities, startups, small to medium-sized businesses, global brands, and large-scale international organizations.

Webcast and Conference Call Information

NetApp will host a conference call to discuss these results today at 2:00 p.m. Pacific Time. To access the live webcast of this event, go to the NetApp Investor Relations website at investors.netapp.com. In addition, this press release, historical supplemental data tables, and other information related to the call will be posted on the Investor Relations website. An audio replay will be available on the website after 4:00 p.m. Pacific Time today.

Background Information

NetApp

NetApp creates innovative products storage systems and software that help customers around the world store, manage, protect, and retain one of their most precious corporate assets: their data.

It provides expert services and global support to maximize the value customers derive from its products and to keep its systems up and running.