Sharjah Islamic Bank Net Profit Surges 7 Percent to Dh510 Million; Proposes 8 Percent Cash Dividend

Sharjah Islamic Bank (SIB) achieved good results for the full year of 2018 and declared a net profit of AED 510.4 million compared to AED 477.7 million reported in 2017, showing an increase of 7%. An 8% cash dividend is proposed for the shareholders.

These results reflect the success of the bank's strategy to achieve steady and stable growth in profitability and its financial position with total operating income reaching AED 1.7 billion in 2018 compared to AED 1.5 billion in 2017, achieving an increase of AED 225.8 million or 15.2%. Total fees and other income from investments and subsidiaries increased by AED 21.0 million or 4% to reach AED 541.3 million in 2018, whereas net operating income reached AED 1.1 billion in 2018 compared to AED 0.9 billion last year, recording an increase of AED 154.0 million or 16.5%.

The balance sheet reflects the Bank’s strong performance and sound financial position with total assets reaching AED 44.7 billion at the end of December 2018, growing by 17% compared to AED 38.3 billion at the end of 2017.

Liquid assets of the bank reached AED 9.7 billion or 21.6% of the total assets at the end of December 2018. The bank continued to provide financing facilities to large companies and SME’S in different economic sectors in accordance with its prudent credit policy that takes into consideration the prevailing market volatility and instability in global and regional capital markets. Financing facilities reached AED 24.1 billion compared to AED 21.7 billion in 2017, showing an increase of AED 2.4 billion or 11%.

SIB successfully attracted more deposits during the year as customer deposits increased by 18.5% amounting to AED 4.1 billion to reach AED 26.4 billion compared to AED 22.3 billion in the previous year.

During 2018, Sharjah Islamic Bank issued a USD 500 million five-year sukuk as part of its USD 3 billion medium-term notes sukuk programme, thus enhancing the bank's position in the field of international sukuk market. It is worth mentioning that this was SIB’s sixth sukuk issuance since 2006 supporting its strategic objectives to diversify sources of funding. As a result, outstanding sukuk reached AED 5.5 billion by the end of December 2018.

Sharjah Islamic bank’s strong performance reflected positively on its financial indicators. Basel III Capital adequacy ratio stood at 17.690 % by the end of 2018 far above the Central Bank of UAE’s minimum requirement of 12.375%.

Sharjah Islamic bank operates in a highly competitive environment with a large local branch network of 34 branches supported by 149 ATMs distributed across all emirates.

Background Information

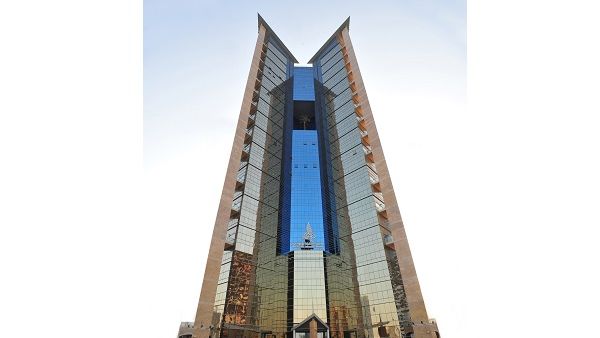

Sharjah Islamic Bank

We believe in our vision and values just as strongly today as we did the first time we put them on paper more than 30 years ago.

Sharjah Islamic Bank (SIB) started servicing the society in 1975; providing banking services to individuals and companies. An Amiri decree; released by His Highness Dr. Sheikh Sultan Bin Mohamed Al Qassimi the member of the Supreme Council & Ruler of Sharjah, was issued to launch & green-light the bank’s expedition. The bank was originally founded as National Bank of Sharjah and was suited the first bank to convert to Islamic Banking in 2002.