UAE Federal Tax Authority Outlines Simple 4-Step Procedure for Submitting Tax Returns Online

The Federal Tax Authority (FTA) has outlined a simple four-step online procedure allowing businesses to easily submit their tax returns via the e-Services portal on the Authority’s website.

The FTA launched a comprehensive awareness campaign titled “Filing Returns in 4 Steps”, covering social, digital and other media channels. The campaign targets businesses registered for Value Added Tax (VAT), introducing them to the online system that the FTA had launched. From the beginning of February 2018, the system has been open to receiving tax returns for the first Tax Period ending on January 31, 2018, for some businesses, which are required to submit their returns no later than February 28, 2018.

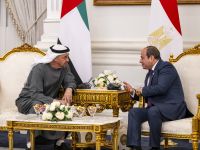

His Excellency Khalid Al Bustani, FTA Director General, said that tax returns can be submitted 24/7 through the e-Services portal on the Authority’s website, which was designed based on international best practice to help registrants submit their tax returns and raise tax awareness among the public. H.E. reiterated the FTA’s commitment to providing businesses with best-in-class electronic services that allow them to easily register and submit their returns.

The success of the UAE tax system is a shared responsibility requiring continuous strategic collaboration between the public and private sectors, H.E. Al Bustani stressed, noting that the Federal Tax Authority works hand in hand with all relevant authorities to provide taxable businesses with the best services.

Monthly and Quarterly returns

In its “filing Returns in 4 Steps” campaign, the FTA explains that businesses registered in the VAT system are required to submit their returns on a monthly or quarterly basis, as specified by the Authority. Information about Tax Periods is available on the FTA website, where registered businesses can check their allocated tax periods and whether their first tax period ended on 31 January 2018.

The Authority mandates that Tax Returns must be received no later than the 28th day following the end of the Tax Period concerned, providing a number of methods to process the payment of any tax via the e-Dirham platform.

The FTA stressed that Taxable Persons should prepare all tax return requirements before starting the online submission.

Four Steps

The first step to submitting tax returns is to enter the e-Services portal on the Authority’s website, then choose the “VAT” tab and scroll to the company’s dedicated “VAT Returns” page and initiate a new VAT return.

Step two is to enter the data in the return, including sales and other outputs, and expenses and other input, writing the net amount excluding VAT, as well as the VAT amount. And the system will calculate the tax payable or repayable.

The third step is to submit the tax return after thoroughly reviewing it, while the fourth and final step is to pay the due tax through “My Payments” tab, ensuring payment deadlines are met.

Background Information

Federal Tax Authority

By virtue of this Federal Law by Decree a public federal authority shall be established under the name of the Federal Tax Authority. The headquarters of the authority shall be located in the city of Abu Dhabi. The authority shall be in charge of managing and collecting federal taxes and related fines, distributing tax-generated revenues and applying the tax-related procedures in force in the UAE.

The authority shall be managed by a board of directors chaired by the Minister of Finance and a sufficient number of members to be appointed and remunerated by a Cabinet resolution, based on the chairman’s nomination. The authority shall have an independent annual budget that shall be deemed as public funds and exempted from all taxes and fees.