UAE signs Agreement on Mutual Administrative Assistance in Tax Matters (MAC)

The Ministry of Finance (MoF) has announced that the UAE has signed an Agreement on Mutual Administrative Assistance in Tax Matters (MAC) at the headquarters of the Organization for Economic Cooperation and Development (OECD) last week in Paris, France. The MAC follows the UAE’s commitment to implement international standards and requirements of the exchange of information for tax purposes, and its membership of the Global Forum on Transparency and Exchange of Information.

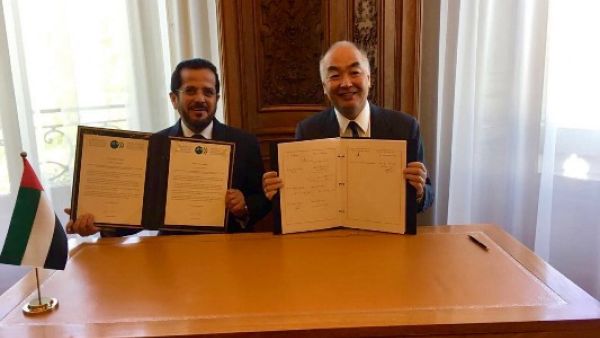

The MAC was signed by HE Maadhad Hareb Mughair Al Khaili, UAE Ambassador to the Republic of France, in the presence of Mr. Rintaro Tamaki, Deputy Secretary-General of the OECD, and representatives from MoF and OECD.

HE Obaid Humaid Al Tayer, Minister of State for Financial Affairs, stressed the country’s commitment to implementing international requirements and the legal framework adopted by OECD to enhance tax transparency and exchange of information between countries. HE said: “The Ministry of Finance is committed to the responsibility it was entrusted to by the UAE Cabinet, which is the collection and exchange of information for tax purposes in coordination with the concerned authorities in respective countries. This responsibility lies in the framework of bilateral agreements on the avoidance of double taxation previously signed by the UAE, and now falls under the Agreement on Mutual Administrative Assistance in Tax Matters.”

HE added: “The Agreement on Mutual Administrative Assistance in Tax Matters is considered the legal framework for the exchange of information for tax purposes on individuals and institutions residing in the respective 108 countries which have signed this Agreement to date. These countries include the G20, OECD member countries, countries with emerging economies and financial centers, as well as a number of developing countries. The Agreement aims to promote transparency and cooperation in the field of taxation among these member states, following G20 directives to strengthen the international taxation system and create a transparent environment for taxation, which has become an international priority to address tax evasion.”

Earlier this month, HE Obaid Al Tayer, Minister of State for Financial Affairs, signed the Multilateral Competent Authority Agreement (MCAA), in accordance with the Common Reporting Standard (CRS), as a step towards activating the exchange of information for tax purposes in 2018. The MCAA regulates the automatic exchange of financial account information on individuals residing in the UAE for tax purposes.

The signing of the MCA and the UAE’s compliance with international requirements in the area of multilateral agreements on tax cooperation will strengthen the UAE’s position as a global financial and trading center, as well as enhance its competitiveness in the field of taxation. To date, the UAE has signed 104 bilateral agreements to avoid double taxation, eight agreements on the exchange of information for tax purposes, in addition to signing an agreement with FATCA, which includes bilateral cooperation in the exchange of tax information.

Read more:

MoF organises a series of sessions and meetings on the sidelines of the World Government Summit 2017

MoF organises workshop on best practices in budget transparency

Background Information

UAE Ministry of Finance

The UAE Ministry of Finance (MoF) is responsible for implementing all fiscal, monetary and industrial policies related to the UAE’s economic development. Among its core responsibilities are the preparation and allocation of the Federal Budget and the management of the government’s financial position.