Oman to add US$6 billion in Islamic assets, says Ernst & Young

A successful roll-out of Islamic banking system could easily see the industry in Oman gaining up to US$6 billion in Islamic assets over next few years, according to estimates by Ernst & Young’s Islamic Financial Services Group (IFSG).

Total banking assets in Oman in 2010 were estimated to be US$42 billion. Shari’a-compliant financial institutions, which are expected to commence operation in the country within a short period, are expected to capture a substantial share of this market and of total banking assets within a few years.

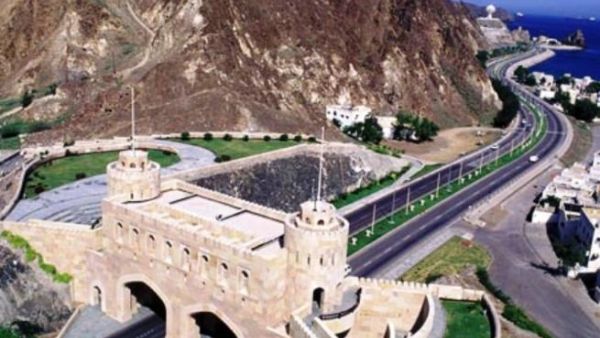

Speaking at Ernst & Young’s Islamic Banking session at the Muscat Holiday Hotel, Ashar Nazim, Executive Director and Head of Islamic Financial Services, Ernst & Young MENA said: “The Islamic banking opportunity could be substantial as we expect the industry to reflect its performance in other GCC markets. As an indication of how Islamic banking would evolve in Oman, we can look at the neighboring UAE market, where it has captured a significant share in a short period of time. New Islamic banks and Islamic banking windows in conventional banks are set to capture a significant share of the market over the coming months.”

Global Shari’a-compliant assets are estimated to have crossed $1 trillion in 2010, growing at a sustainable 15-30 per cent per annum.

He added: “Given the size of the local market, early movers are set to create a strong advantage in both Islamic banking and takaful. The next 18 months could materially change the competitive landscape in favor of Islamic windows and banks.”

Conventional banks will be the first to market with Islamic windows

The Central Bank of Oman has permitted conventional banks to operate their Islamic banking business through a ‘window’ operation. As a result, the market could see a number of conventional banks entering the Islamic finance space in the next couple of years.

Ahmed Al Esry, Senior Director, Tax, Ernst & Young Oman, said: “The Islamic banking window operation is accepted as a successful model and in many markets such as Saudi Arabia, where Islamic windows account for nearly half of the Shari’a assets, and UAE where they have an 11% share. Given the similarities in the demographic landscape and appetite for these services, we see great potential in the Omani market for Islamic offerings. Successful Islamic windows understand the various Shari’a implications on the banking business and are able to apply its requirements in their strategy, operations, product, and governance and risk management functions.”

The concept of Islamic banking window requires the conventional financial institution to have a distinct operational infrastructure for its Islamic business. Compliance is monitored by the regulator as well as the Shari’a authorities and further strengthened through independent Shari’a audits conducted by professional firms.

Local Sukuks to aid the growth of Oman’s economy

Oman is expected to benefit from the most notable development in the Islamic finance market in 2010 - the growth of the Sukuk market. Sukuks are the Shari’a-compliant form of conventional bonds and have a growing acceptability in international markets. Omani Sukuk instruments could be used for financing infrastructure projects and stimulating corporate activity, which would add to the growth of Oman’s buoyant economy.

Background Information

Ernst & Young

In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience (e.g. remember settings), Performance cookies to measure the website's performance and improve your experience, Advertising/Targeting cookies, which are set by third parties with whom we execute advertising campaigns and allow us to provide you with advertisements relevant to you, Social media cookies, which allow you to share the content on this website on social media like Facebook and Twitter.