ALBAWABA – China property stocks surged on Tuesday on news that the government is preparing a credit package to finance 50 real estate firms to support the debt-laden sector as shares of Sunac China Holdings Ltd. rallied, according to Bloomberg.

A Bloomberg gauge of China developer stocks gained 7.6 percent, to head for its biggest advance since September, on news that Beijing is preparing a white list of developers eligible to receive state funding.

Meanwhile, Sunac., the first major Chinese builder to reach a restructuring agreement, led the sector’s rise as its stocks rallied around 27 percent.

Likewise, Seazen Group Ltd. and Agile Group Holdings Ltd. also climbed.

The so-called white list may help alleviate fears of further debt and default contagion in China’s property sector, Bloomberg reported, but it is not a directive for banks to extend loans to real estate firms.

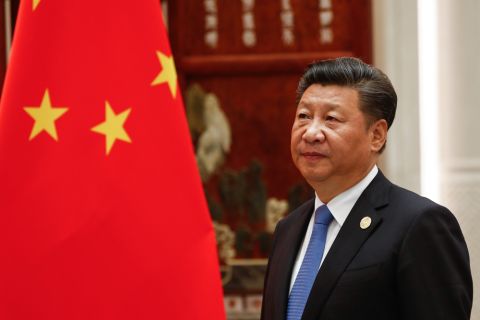

The China property developers sector is struggling with debt and liquidity shortages - Shutterstock

That said, it remains to be seen if the move will halt the industry’s long-running slump.

China Vanke Co., the nation’s second-biggest developer by sales, led gains in property bonds after its 3.5 percent notes due 2029 rose 2.7 cents to 61 cents on the dollar as of 1:53 pm in Hong Kong, as reported by Bloomberg. Longfor and Seazen’s notes also advanced, although the bonds still trade at distressed levels.

Overall, the real estate industry contracted 2.7 percent in the third quarter, the biggest drop this year, according to Bloomberg.

Home prices declined the most in eight years in October and funding for property development dropped 13.8 percent on-year in the first 10 months of 2023.

China’s biggest banks, brokerages and distressed asset managers were told to meet all “reasonable” funding needs from property firms at a Friday gathering with the top financial regulators, according to a government statement that didn’t mention a white list, carried by the New York-based news agency.

Financial firms were also asked to “treat private and state-owned developers the same” when it comes to lending. Still, some investors remain doubtful that the measures can reverse the sector’s slide.