Markaz Report: GCC Fixed Income market sees USD 38.74 billion in primary issuances during Q3 2025 representing a 32% increase from the same period last year

In its Fixed Income Report, Kuwait Financial Centre “Markaz” states that primary debt issuances of Bonds and Sukuk in the Gulf Cooperation Council (“GCC”) Countries amounted to USD 38.74 billion through 137 issuances during Q3 2025, a 32.28% increase from the same period last year, where issuances in Q3 2024 amounted to USD 29.29 billion.

Issuances by Geography: Saudi-based issuances led the GCC during Q3 2025, raising USD 20.32 billion through 36 issuances, up from USD 12.49 billion in Q3 2024, an increase of 62.8%, and representing 52.5% of issuances during the year. UAE- based issuances ranked second, with USD 5.82 billion through 57 issuances, representing 15.0% of the market, a decrease of 47.3% from the same period last year. Qatari entities were the third largest issuers in terms of value, with USD 5.69 billion issued through 29 issuances, representing 14.7% of the issuances over the period. Kuwaiti issuers follow, with a total issuance size of USD 3.42 billion through 8 issuances, a 118.4% increase from the same period last year.

Bahraini issuances recorded a 539% increase from the same period last year, recording a total value of USD 2.55 billion through 4 issuances. Omani entities recorded the lowest value of issuances during the year, with USD 0.94 billion raised through 3 issuances, representing 2.4% of the total value of issuances.

Sovereign vs. Corporate: Total GCC corporate primary issuances increased by 4.0% in Q3 2025, amounting to USD 26.59 billion raised, compared to USD 25.57 billion raised in Q3 2024. Corporate issuances represented 68.6% of total issuances for the third quarter of 2025, in line with the preference of issuances in Q3 2024 where more corporates issued than sovereigns (Corporate issuances Q3 2024: 87.3%). Government related corporate entities raised USD 3.1 billion through 3 issuances during the quarter, an increase of 57% from Q3 2024 (USD 2.0 billion through 2 issuances). Total GCC sovereign primary issuances increased by 227% in Q3 2025, raising USD 12.14 billion throughout the year, representing 31.4% of total issuances.

Conventional vs. Sukuk: Conventional issuances decreased by 18.6% in Q3 2025 compared to Q3 2024, raising a total of USD 18.37 billion for the quarter. Sukuk issuances, meanwhile, increased by 202.7% in Q3 2025, resulting in a total value of USD 20.37 billion for the year so far. As for issuance preferences, Q3 2025 saw an increased appetite for sukuk issuances in the GCC, representing 52.6% of total issuances for the year. This is a change in issuance preferences from Q3 2024, where more conventional bonds were issued.

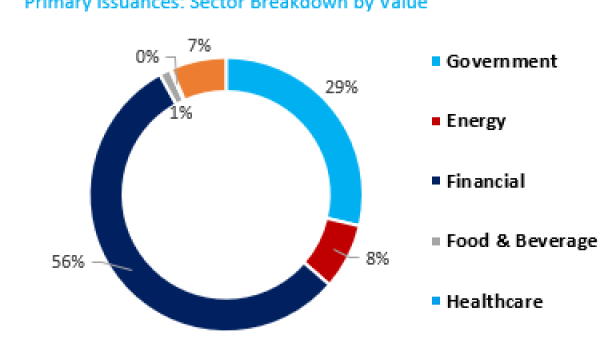

Sector Segmentation: The Financial sector led the bond and sukuk issuances in Q3 2025, with total value of USD 21.53 billion through 113 issuances representing 55.6% of total issuances. Government issuances follow, with USD 11.1 billion through 15 issuances, representing 28.7% of total issuances. This represents an increase for both the financial sector (115.3%) and for government issuances (199.0%) when compared to the same period last year. The energy sector follows, with USD 3.0 billion through 2 issuances, representing 7.7% of total issuances, with the remaining sectors together representing a small portion of total issuance (8.0%).

Maturity Profile: In Q3 2025, primary issuances with less than 5-year tenors represented 53.1% of GCC debt capital markets with a total value amounting to USD 20.6 billion through 100 issuances. Primary issuances with 5–10-year tenors followed, raising USD 12.5 billion through 26 issuances, representing 32.2% of total issuances. Primary issuances with 10–30-year tenors represented 3.3% of GCC debt capital markets with a total value of USD 1.3 billion through 3 issuances during the year. No issuances came in with a maturity greater than (“GT”) 30 years, while perpetual issuances saw an increase in both the size and number of issuances when compared to Q3 2024, with a total value of USD 4.4 billion through 8 issuances.

Issue Size Profile: During Q3 2025, GCC primary issuances ranged in size from USD 3.0 million to USD 3.25 billion. Issuances with issue size of USD 1 billion or greater raised the largest amount, totaling USD 17.1 billion through 11 issuances and representing 44.0% of the total amount issued in the GCC. Issuances sized between USD 500 million and USD 1 billion followed, with a total issuance size of USD 12.4 billion through 20 issuances. The highest number of issuances was under USD 100 million issue size, where there were 81 issuances that raised a total amount of USD 2.9 billion during Q3 2025.

Currency Profile: US Dollar-denominated issuances led the GCC Bonds and Sukuk primary market again in Q3 2025, raising a total of USD 28.1 billion through 74 issuances, representing a substantial 72.5% of the total value raised in primary issuances during the quarter. The second largest issue currency was the Kuwaiti Dinar (KWD), where KWD denominated issuances raised a total of USD 2.6 billion through 7 issuances. As for currencies bucketed under “Other” which totaled USD 2.0 billion, the Hong Kong Dollar (HKD) represented 1.79% of total issuances with a total value of USD 694 million through 19 issuances.

Rating: In terms of value, a total of 68.4% of GCC Conventional and Sukuk bonds were rated in Q3 2025 by at least one of the following rating agencies: Standard & Poor’s, Moody’s, Fitch and Capital Intelligence, a decrease from Q3 2024 (77.0% of all issuances rated). Issuances rated within the Investment Grade accounted for 61.0% of the total issuances during the year, while Sub-Investment Grade accounted for 7.4% of rated bonds.

Background Information

Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.03 billion as of 30 September 2020 (USD 3.33 billion). Markaz was listed on the Boursa Kuwait in 1997.