Tally Solutions Introduces a Visual Guide to Assist Businesses on Details of Filing VAT Returns

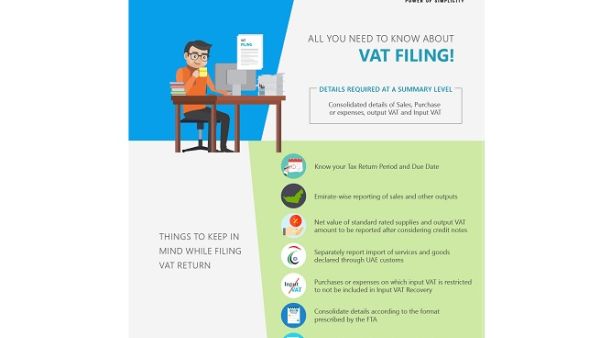

As the deadline to file Value Added Tax (VAT) returns approaches soon, Tally Solutions - a leading international accounting and compliance software provider has introduced a new visual guide that explains in simple terms the list of things that businesses should keep in mind before filing the returns.

“While most businesses are aware of the impact of taxes, filing returns can be an incredibly complex task which often catches business owners and employees by surprise. Businesses are required to file VAT Return online using the Federal Tax Authority (FTA) portal and the portal is designed to accept the returns only through online mode. This implies that the taxpayer is required to manually provide the values of Sales, Purchase, Output VAT, Input and Input VAT etc. in the appropriate boxes of the VAT return form available in FTA portal.” said Vikas Panchal, Business Head at Tally Solution in the Middle East.

Spread over two sections, the new infographic guide covers information on – (1) Important things to keep in mind while filing VAT return and (2) the subsequent consequences of incorrect filing. Due to the complexity of calculation as per the prescribed format, businesses may face a challenge to manually collate and compile transactions, which could eventually lead to missing deadlines and non-compliance.

“Taxes can be complicated, particularly when you are filing it last minute. Over the last few months, through various medium (webinars, events, blogs) we have tried to educate businesses on the proper method of filing. The latest visual guide is another attempt to reach out to as many businesses as possible,” added Vikas Panchal.

The Federal Tax Authority (FTA) has urged businesses in the UAE to file their VAT returns by no later than the 28th of May to avoid penalties. VAT returns must be filed monthly by companies with annual turnover above Dh150 million, while businesses with revenue below that level must file quarterly.

Tally Solutions is a leading international accounting and compliance software provider which has recently introduced Value Added Tax (VAT) software - Tally.ERP 9 Release 6.4 to help businesses comply with VAT protocol and procedures. Trusted by more than 1.2 million businesses globally, Tally Solutions already includes a list of 50,000 satisfied clients across GCC.

The Infographic guide is developed in an easy and simple to read format and is available on the company’s website which can be accessed here – https://tallysolutions.com/mena/vat-return/checklist-vat-return-filing/

Background Information

Tally Solutions

Tally Solutions Pvt. Ltd. is a pioneer in the business software products arena. Since its inception in 1986, Tally’s simple yet powerful products have been revolutionizing the way businesses run. Having delivered path breaking technology consistently for more than 30 years, Tally symbolizes unmatched innovation and leadership. Today, it caters to millions of users across industries in 140 countries and continues to be the unchallenged industry leader in the enterprise resource planning software domain.