ALBAWABA - Samsung Electronics said that it had achieved its highest growth rate since the year 2010, with operational profits surging for the second quarter. This comes as semiconductor prices have begun to recover and consumer appetite for generative artificial intelligence (AI) continues to increase.

For the second quarter that ended on June 30, 2024, the Company reported financial results which included a consolidated revenue of KRW 74.07 trillion ($54.1 billion) and an operating profit of KRW 10.44 trillion ($7.5 billion), 15 times in contrast to same period last year, according to ABC news.

The desirable circumstances in the memory market enabled an increase in the average sales price (ASP), and strong demand for OLED panels both contributed to the results.

As major companies and cloud service providers put more money into AI, artificial intelligence computers are likely to make up a bigger part of the market in the second half of 2024, Samsung says. Given that AI servers with HBM also have high content-per-box compared to regular DRAM and SSDs, demand is likely to stay high for all of these products, from HBM and DDR5 to server SSDs.

The company aims to meet the demand for AI services that are higher additional value products, which intend to boost their ability to make more HBM3E sales. The Korean tech maker will also concentrate on high-density goods, like server modules made with 1b-nm 32Gb DDR5 in server DRAM.

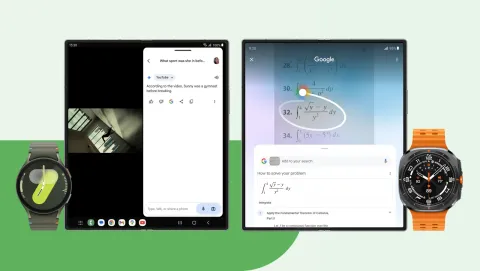

The mobile display company reported an increase in revenues, which was driven by a strong demand for flagship products and by efficiently supporting new smartphone launches from major clients. Additional factors that contributed to greater performance were prompt responses to client demands and a consistent supply of IT OLED products.

While seasonal tendencies persisted in the smartphone industry, overall market demand fell sequentially, especially in the luxury sector. The Galaxy S24 series demonstrated the series' ongoing success in the second quarter and first half of the year by seeing double-digit year-over-year increase in both shipments and revenue over its predecessor, while the MX Business had a sequential fall in sales.